This is a question that comes up pretty often with UK traders / spread bettors “How do I calculate my spread betting lot size?” – I’ll give you the answer, and it’s a pretty simple one: you are risking a certain amount per point of movement, not using lot sizes in the traditional sense.

What is lot sizing?

Lot sizing is one of those things that sounds technical, but once you get your head around it, it’s simple. More importantly, it’s essential. Because in spread betting, your risk per point is everything. It determines your profit, your risk, and, quite often, how long you survive in the game.

So let’s walk through how to calculate your lot size when spread betting.

What Is a “Lot Size” in Spread Betting?

In spread betting, you don’t buy lots in the traditional forex or CFD sense. You bet per point of movement.

If you’re trading GBP/USD and you place a £5-per-point bet, every 1-point move in price means you make (or lose) £5.

So in spread betting, lot size = stake size = £ per point. Simple.

The tricky part is knowing how much to bet per point based on your account size, the pair you’re trading, and how much risk you’re willing to take.

How to Calculate Your Spread Betting Lot Size

Step 1: Decide How Much You’re Willing to Risk

Forget the potential profit — start by deciding how much you’re willing to lose if the trade goes wrong.

A good rule of thumb is 1–2% of your total account per trade.

So if you’ve got £5,000 in your trading account and you don’t want to lose more than 1% per trade, that’s £50 of risk per trade.

This is your maximum loss, and it’s the number everything else is based on.

Step 2: Know Your Stop-Loss Distance

Next, figure out how wide your stop-loss is. Not in pounds — in points.

If you’re going long on GBP/USD and your stop-loss is 50 points below your entry, that’s a 50-point stop.

Be realistic here. If your strategy requires a 25-point stop, use that. If it’s a volatile instrument like the NASDAQ and you need 120 points of breathing room, use that.

This matters — because the wider your stop, the smaller your stake should be.

Step 3: Use This Super Simple Formula (or calculator)

Now for the fun part.

Take your £ amount at risk, and divide it by your stop-loss in points.

That’s it. That’s your ideal lot size — your stake per point.

Example:

- You want to risk £50

- Your stop-loss is 25 points

- £50 ÷ 25 = £2 per point

That means if the trade hits your stop, you’ll lose exactly £50 — not £150 because you “rounded up” or just guessed.

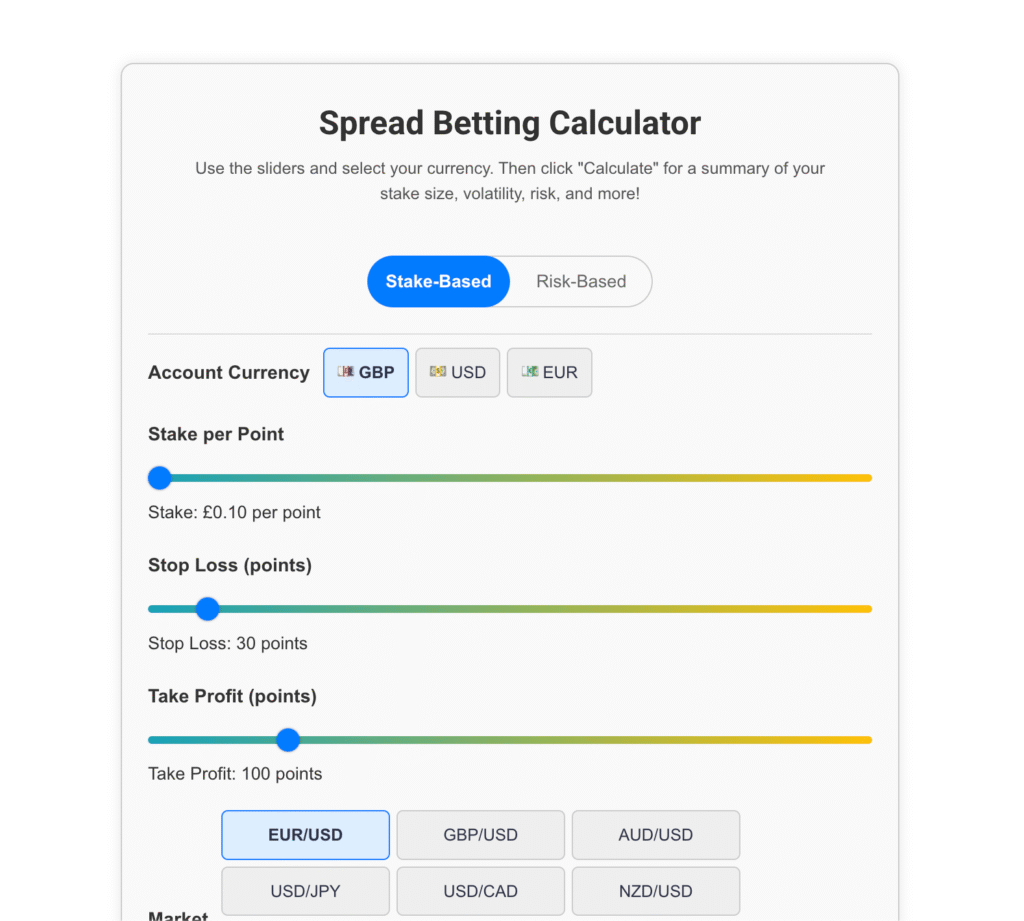

If you are still at a loss here, there are some super useful spread bet calculators online that you can use for free which speeds up the process.

Bonus: What About Calculating for Indexes or Commodities?

Same principle.

Let’s say you’re trading the FTSE 100, and it’s sitting at 8,000. You want to go short, with a stop-loss 40 points above.

You only want to risk £100. So:

- £100 ÷ 40 = £2.50 per point

That’s your lot size.

You don’t need to overthink pip values, contract specs, or anything else — the broker already handles that in the spread betting format. You just need to focus on £ per point, your stop, and your risk per trade.

Common Mistakes to Avoid

Betting a Fixed Amount Per Trade

“I always trade £10/point.”

Cool — until your stop is 80 points and you accidentally torch £800 on a single bad setup.

Don’t use the same stake on every trade. Your stop-loss distance changes — your lot size should too.

Ignoring Volatility

EUR/USD and Bitcoin don’t move the same way. Your strategy might need a 20-point stop for one, and a 200-point stop for the other. If you use the same stake for both, one of those is going to end badly.

Rounding Up Out of Ego

You calculated £2.40/point but decide to round it up to £5 “to make it worth it.”

That’s not brave — that’s reckless. Stick to the numbers. That’s how traders stay in the game long enough to compound.

Cheat Sheet

Here’s a cheat sheet to keep in your back pocket:

| Account Size | Max Risk (1%) | 25-Point Stop | 50-Point Stop |

| £1,000 | £10 | £0.40/point | £0.20/point |

| £5,000 | £50 | £2.00/point | £1.00/point |

| £10,000 | £100 | £4.00/point | £2.00/point |

You get the idea. The more capital you’ve got, the more you can risk responsibly — but only if your trade setup supports it.

Final Thoughts

Spread betting is simple in theory — you stake a certain amount per point, and your P&L moves with the market.

But if you’re not calculating your stake based on risk and stop-loss, you’re not trading — you’re gambling.

This isn’t about being ultra-conservative. It’s about being smart. Because once you get lot size calculated properly, you can trade bigger with confidence. You know your downside. You know when to step back. And you’ll stop blowing up accounts because you went too big on a bad day.

So don’t guess. Don’t round. Don’t “feel” your way through position sizing.

Do the math, place the trade, manage the risk.

That’s how real traders play the spread betting game.