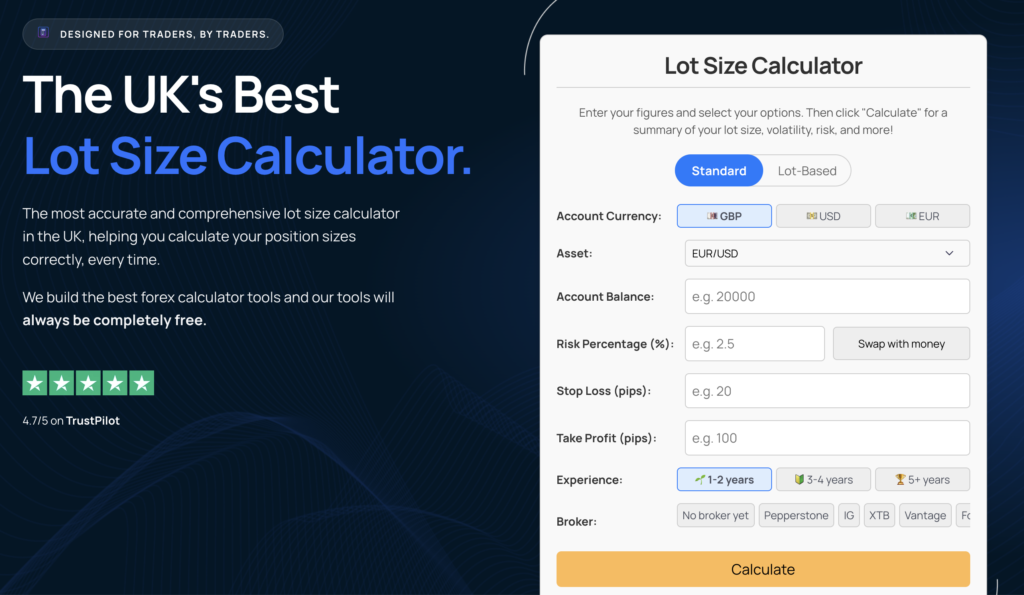

How we built the most advanced lot size calculator in the UK

When we first set out to build our lot size calculator at lotsizecalculator.co.uk, we had a simple idea: traders need a tool that properly reflects the real-world complexities of risk management.

Too many lot size calculators skip the details, asking for just your account balance and stop loss in pips. If you’re a beginner or even an intermediate trader, you’re left scratching your head, wondering how to handle volatility differences, currency conversions, or whether you should risk a fixed amount of money versus a percentage of your balance. So we decided to go deeper—to fold all those moving parts into one friendly interface.

We wanted to create a place where you can, in just a few clicks, see how big your lot size should be, how much money you’re risking, and what that risk means for you in practical terms. Because, let’s face it, it’s not enough to say, “I’m trading 0.2 lots.” The real question is, “How many pounds, dollars, or euros am I actually risking on this trade, and how does that stack up against the typical volatility of the pair I’m trading?” That’s exactly what our calculator aims to answer.

Below is a behind-the-scenes glimpse into what makes our lot size calculator special. We won’t be talking about the code itself—just the factors we account for to ensure you can dial in the perfect lot size every time you trade.

Why a better lot size calculator matters

If you’ve used a standard, bare-bones lot size calculator before, you’ve likely encountered something like this:

- input your account balance

- input your risk percentage

- input your stop loss in pips

- out pops a lot size

That’s a decent start, but real trading can involve so many extra elements. Suppose you’re trading GBP/JPY, which is known for bigger moves compared to EUR/USD. If your calculator doesn’t factor in pair-specific volatility, you might get a misleading sense of how risky your trade is. Or, what if you want to risk a fixed amount of money—say £250—rather than an arbitrary percentage? Many calculators force you to only pick a percentage. We wanted ours to handle both.

We also realised that some traders might need to consider the currency of their account. Are you trading with a GBP account, a USD account, or something else entirely? Converting from pips to actual monetary risk depends on exchange rates or at least some multiplier. So we included that. On top of that, we wanted to let you pick your broker. While we don’t claim to produce a final “this broker is best for you” recommendation, referencing your broker in the calculation can help you stay mindful that each brokerage environment might be slightly different (e.g., in terms of quoting style or minimum lot sizes).

The big factors we considered

When we built Lot Size Calculator, we sat down and identified the primary real-world variables that every trader grapples with. We then asked ourselves: how do we incorporate each one?

- currency of your trading account

If you’re trading from the UK, your balance might be in GBP. But some might have an account in USD, some in EUR, and so on. If your account currency is GBP but you’re trading, say, EUR/USD, we need to estimate how a pip in that pair translates to pounds. Some calculators skip this step, assuming everything is denominated in USD. We didn’t want that. So we made sure the user picks their account currency and the calculator adjusts accordingly. - the pair you’re trading

EUR/USD, GBP/JPY, XAU/USD (gold), OIL, even BTC/USD. Each of these “pairs” (or assets, in the case of gold, oil, or crypto) can have a different standard pip value or typical volatility. For example, a 20-pip move in GBP/JPY might be more impactful than a 20-pip move in EUR/USD, due to how these pairs are quoted or how large their typical range is in a day. We wanted the user to be able to pick from a wide range of popular instruments—Forex, commodities, and even crypto—and see a relevant risk calculation. - account balance

This one is straightforward. But we wanted to ensure that when you enter your balance, the calculator doesn’t just interpret it as “that’s it, we’re done.” Instead, we also track whether you want to risk a certain percentage of that balance or a specific chunk of money. The reason? Some traders say, “I like to keep risk at 2% per trade,” while others prefer, “I’ll risk exactly $200 every time, no matter the account size.” We let you do either. - risk percentage vs. fixed money risk

We noticed that most people learning about risk management are taught “risk 1-2% of your balance per trade.” That’s great advice, but it’s not universal. Some might want to do 1% on one trade, 2% on another, or skip percentages altogether and say, “I’ll risk exactly 100 dollars.” So if you switch our calculator to “percent” mode, you can type in something like 2.5%, and it’ll figure out your lot size. If you switch to “money” mode, you can type in a fixed figure—like 250, meaning £250 or $250, etc.—and the calculator will figure out your lot size that way. We think that’s a game-changer for those who have a set monetary risk comfort level, rather than a purely percentage-based approach. - stop loss & take profit

In trading, your stop loss (SL) is how many pips away you place your exit if the trade goes against you. Meanwhile, your take profit (TP) is how many pips away you aim to exit if the trade goes in your favour. Many calculators just ask for your stop loss. We decided it’s worth collecting your take profit too, so we can help you see your potential risk-to-reward ratio. Sometimes you’ll see that if your take profit is only 20 pips away but your stop is 40 pips away, you’ve got a 1:0.5 R:R ratio, which might not be so hot. The calculator immediately calls that out by showing you something like “1:0.50” or “1:2.00,” depending on your scenario. We see this as an extra nudge towards better risk-reward awareness. - volatility classification

Let’s face it: certain pairs and assets are just wilder. If you’re used to trading EUR/USD, which is relatively stable, you might be in for a shock if you suddenly jump into GBP/JPY or BTC/USD. So we assigned a “volatility rating” for each major pair or asset. Low-volatility pairs might be labeled as “Low,” whereas something like GBP/JPY or BTC/USD might be “High.” Then we cross-reference that with how you’re risking your account. If you’re risking 3% on a high-volatility pair, the calculator might label your overall risk as “High.” If you’re only risking 1% on a low-volatility pair, it might show “Low” or “Medium.” The point is to give you a heads-up that your strategy is either in a comfortable zone or leaning towards the higher risk side. It’s not a perfect science, but it’s one more real-world factor that typical calculators skip. - broker selection

While the calculator doesn’t change your result drastically based on which broker you pick, we decided to let you choose from a list of popular brokers. Why? Because selecting your broker is part of a real-life mental process. If you haven’t chosen one, you can say “No broker yet.” If you do have a broker, it’s a reminder that you should check any specifics of that broker’s quoting system, minimum lot sizes, or margin requirements. We might expand in the future to incorporate broker-specific constraints (like if a broker requires a certain minimum trade size or step), but even for now, it’s a nice reminder that broker choice matters. - experience level

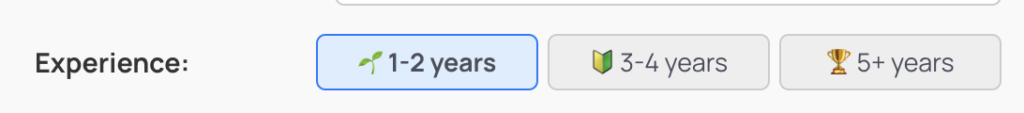

Another personal factor we included is your experience level (e.g., 1-2 years, 3-4 years, 5+ years). This might not change the numerical result, but it helps us—and you—contextualise your risk approach. If you’re brand new, you might think you can handle 5% risk per trade, but that’s a lot if your pair is also extremely volatile. Having the experience level in the UI is a subtle prompt that encourages traders to reflect: “Am I comfortable with this level of risk, given how long I’ve been doing this?”

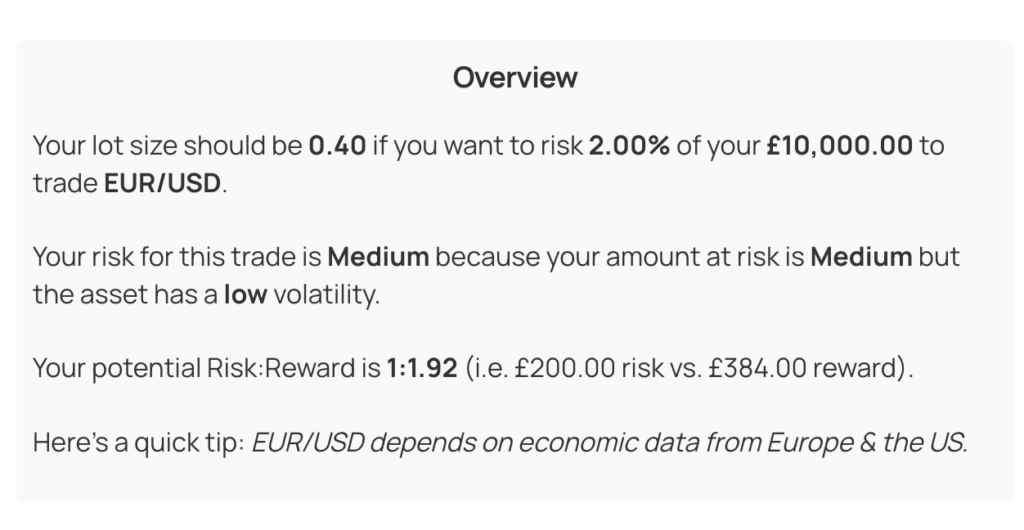

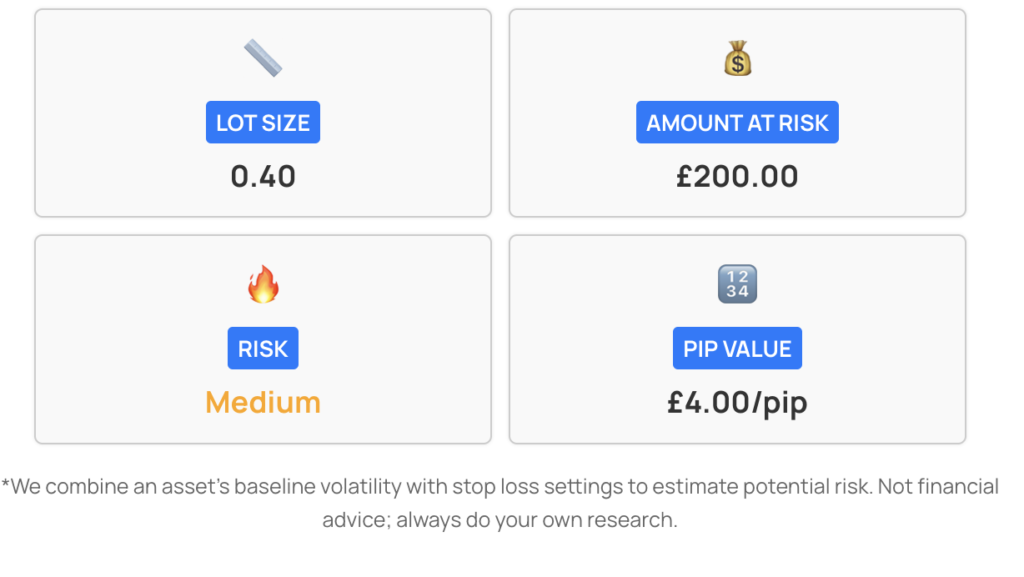

Why we display an overview & summary

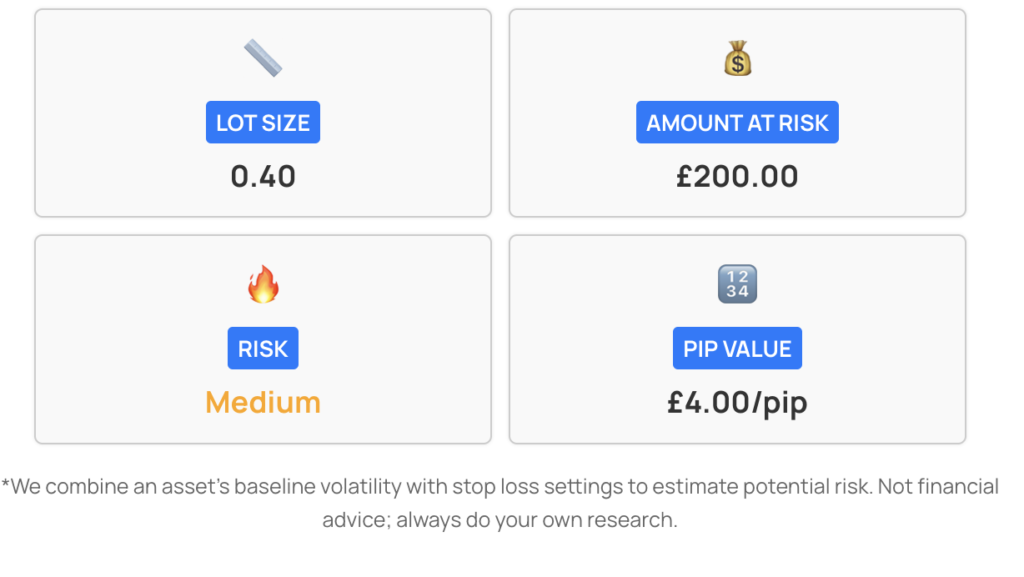

Once you fill in your details (like account balance, stop loss, etc.) and click calculate, our lot size calculator doesn’t just give you a single lot size figure. We also produce an “overview” section that explains, in plain English, how we arrived at your risk classification. For instance, it might say something like:

Your lot size should be 0.25 if you want to risk 2% of your £5,000 balance to trade GBP/JPY. Your risk is considered “High” because you are risking a moderate portion of your account and the asset has “High” volatility.

We do this because we believe that context is everything. It’s one thing to see “0.25” on the screen, but it’s another to see it tied into your strategy: you’re risking a certain amount of real money, your risk vs. reward ratio is 1:2, and you’re dealing with a pair that can move quickly. That holistic perspective helps you decide if you’re truly comfortable hitting the “Place Trade” button in your broker’s platform.

The connection between risk percentage & pair volatility

One of the more unique aspects of our approach is how we combine your risk level with the known typical volatility of the pair you select.

For instance, if you choose to risk 1% of your balance, that’s usually considered “Low” from your personal perspective. But if you select BTC/USD, which is extremely volatile in the crypto space, the final classification might jump to “Medium” or even “High.” In real trading, that’s exactly what you want to know. Sure, you might be personally conservative (low risk percentage), but if your chosen asset is known to swing hundreds of pips in a session, you might still be in for a ride. On the flip side, if you’re risking 3% on a relatively tame pair like EUR/GBP, that might still show “High” from your personal perspective, but the pair’s “Low” volatility might keep it from going off the charts. Our goal is to marry your personal risk appetite with the asset’s inherent volatility, so you never get blindsided.

Money vs. percentage: giving you both options

We can’t emphasize enough how important it was for us to let you switch between risking a percentage of your balance or a fixed monetary amount. For new traders, it’s typical to start with a percentage approach, like 1-2%. But advanced traders sometimes say, “I risk exactly $200 per trade, no matter what my account is.” They do this because it helps them keep a stable mental approach to each trade—same dollar risk every time. If that’s you, you can toggle to the “money” setting on the calculator and type in 200. The tool will figure out how many lots that translates to for the pair you’re trading, factoring in the pip value for that pair, the stop loss, etc.

We find that giving people the flexibility to see both perspectives (percent or money) helps them learn. Some folks might compare: “If I risk 2% of my $5,000 account, that’s $100. But if I do the same trade using a fixed $150 approach, that’s 3%.” You can see the difference in seconds, which might push you to adjust your plan.

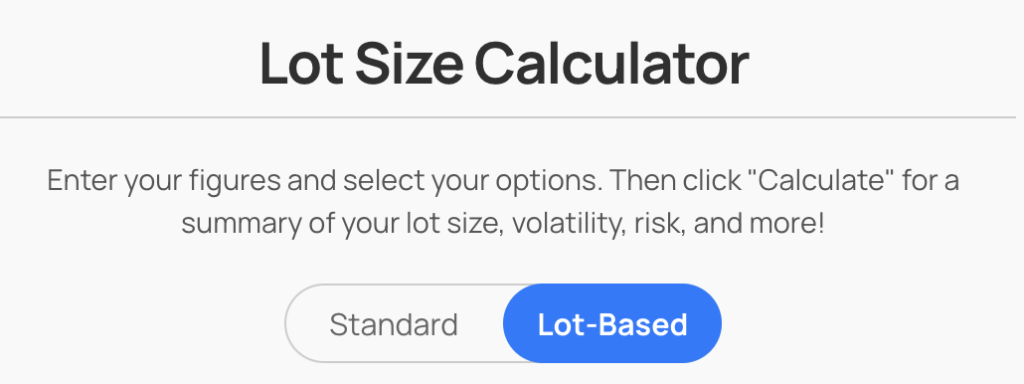

Why we separate “standard” mode and “lot-based” mode

We also introduced the concept of “standard mode” versus “lot-based mode.” In standard mode, you’re starting with your account balance and risk preference, and you want the calculator to spit out your lot size. That’s the typical approach. But some traders do it in reverse: they already have a specific lot size in mind—maybe they read about a setup that suggests “0.3 lots” or they have a personal style that always trades the same lot size—and they just want to see how that translates to actual monetary risk. So they pick “lot-based mode,” plug in 0.3 as the lot size, enter their stop loss in pips, and find out how many pounds or dollars they’re effectively putting at stake if the trade hits their stop. We think of it like a second gear, reversing the flow of the calculation so you can see risk from the perspective of “I already know my position size—how big is that risk?”

Providing quick tips for each pair

Another little feature we added is a short “quick tip” for each asset or pair. For instance, if you pick GBP/JPY, our overview might remind you, “GBP/JPY sees higher volatility; you may consider a bigger SL.” Or if you select EUR/USD, you might see, “EUR/USD depends on economic data from Europe & the US.” This is not intended to be a trading strategy but a small heads-up about known quirks or fundamental drivers for that instrument. The idea is to nudge you to check major upcoming news, interest rate announcements, or commodity updates (for pairs like USD/CAD or OIL) before committing to a position.

Why we ask about your experience level

You might notice that at the top of each mode, you can choose “1-2 years,” “3-4 years,” or “5+ years” of trading experience. This is partly just for your own context, but we also wanted to highlight that a person with 1-2 years of trading might interpret a 2% risk on GBP/JPY differently than a veteran with 5+ years under their belt. We believe it’s psychologically useful to confirm or challenge your comfort zone. If you’re new, maybe keep that risk on the lower side, especially for high-volatility pairs.

The final “risk summary”

We try to tie everything together with a “risk summary” statement. If you’re pairing a relatively low personal risk approach (like 1% or a small monetary figure) with a low-volatility pair (like USD/CHF), you’ll likely see a “Low” or “Medium” rating. If you throw caution to the wind—like risking 5% on BTC/USD—don’t be shocked if the calculator shows “High.” Our reasoning is that these factors really do combine in real life: the bigger the portion of your account you’re risking, and the bigger the historical volatility of the asset, the more “high risk” the trade is likely to be. If we can save at least a few people from stumbling into a huge position on a highly volatile instrument, we’ll consider our job done.

Drawing a risk quadrant

You might notice that once you calculate your trade, we display a small quadrant or chart that tries to place you on an X and Y axis: “Risk Percentage →” vs. “Asset Volatility ↑.” This is a visual way of reinforcing the point. If you’re near the top-right corner, that means you’re risking a high percentage on a high-volatility pair. That’s effectively “the red zone.” Meanwhile, if you’re near the lower-left, it’s a “green zone.” By giving you a quick visual representation, we hope to make risk management more intuitive—and maybe even fun.

Why disclaimers still matter

No matter how many real-world factors we pack into the calculator, trading always has nuances we can’t fully capture. Slippage can occur if the market moves quickly and you don’t get filled at your exact stop loss or entry. Some brokers have minimum lot increments that might require you to pick 0.05 or 0.1 instead of 0.07.

Different instruments have different margin requirements, which can limit your possible lot size. Our disclaimers reflect that we can’t foresee every scenario. The final number we give you is still an estimate. You should double-check it on your broker’s platform or do a final sanity check to ensure you’re not exceeding your comfort zone.

How this helps new traders

A big motivation behind this calculator was hearing from new traders who’d say things like, “I want to trade GBP/JPY with a 50-pip stop, but I don’t know how many lots that translates to or how many dollars that might cost me if I’m wrong.” We think we’ve bridged that gap by letting you see the monetary risk of a certain lot size (or the lot size for a certain monetary risk). Then, with just a quick glance, you see your risk classification, your risk-to-reward ratio, and a small note about the pair’s typical style. That’s an ENORMOUS step toward risk management literacy, which is arguably the single most critical factor in long-term trading success.

Why it’s still valuable for seasoned traders

If you’ve been trading for donkey’s years, you might have your own mental formula, or you might keep an Excel sheet for your trades. But we think even advanced traders might appreciate a straightforward online tool that quickly confirms their calculations.

Maybe you’ve even memorised that 1 pip in GBP/USD is $10 per standard lot in a USD account, but what if your account is in GBP, or you’re dabbling in XAU/USD or OIL for the first time? Our tool can handle that. Maybe you want to see how a 60-pip stop vs. a 40-pip stop changes your risk in actual money. You can punch it in within seconds, and the calculator updates everything for you—no math meltdown needed.

A living, growing tool

One final point: we consider this calculator a living project, not a “done and dusted” static page. We regularly get feedback from traders: “Could you add a feature that does X?” or “I’d love it if you included a second take profit for partial exits.” We’re listening. Trading evolves. The markets evolve. The tools that traders need should evolve too. So expect us to keep refining, adding new pairs, maybe hooking up real-time spread estimates or broker-specific data in the future.

The bottom line

We built lotsizecalculator.co.uk to mirror the complexities of real trading decisions. By factoring in your personal risk preference (fixed money vs. percentage), your account currency, the pair or asset in question, typical volatility, a stop loss and take profit to gauge risk-to-reward, plus quick tips to keep you mindful of external factors, we believe we’ve created one of the most comprehensive and user-friendly lot size calculators out there.

Of course, it can’t magically guarantee anything when it comes to your real-world trading —trading is inherently risky, and no single formula can save a flawed strategy. But with a tool that clarifies exactly what you’re risking, how big your position should be, and how that lines up with the pair’s volatility, you can at least make informed, disciplined decisions. We see that as a big step forward. Because whether you’re brand-new or have been trading for half a decade, you deserve a calculator that goes beyond the basics.

So feel free to open up the calculator, choose your currency, select your broker, pick a pair, and watch the tool seamlessly translate your preferences and risk tolerance into a trade size that matches your style. We hope it’s as much of a game-changer for you as building it has been for us. After all, good risk management is the foundation of every successful trader’s journey, and we’re proud to play a small part in that by giving you a tool that treats risk seriously, comprehensively, and (we hope!) conveniently.