If you’ve been trading for a while or even just dipping your toes in, you know how overwhelming it can get. Markets move quickly, and it’s all too easy to lose track of key fundamentals. Amid the chaos and volatility, there’s one simple tool that deserves more attention than it gets: the lot size calculator. You’ve likely heard about it, maybe even used it, but do you fully understand its potential to transform your trading approach? Let’s delve deeper.

Consistency vs Precision

When I first started trading, I’d hear seasoned traders say things like, “Consistency is the key to success.” But what does consistency actually mean in a practical sense? For me, a turning point came when I realized that it begins with how much you risk on every single trade. Enter the lot size calculator. This isn’t just a numbers tool; it’s the backbone of disciplined, risk-aware trading. And in trading, discipline can mean the difference between growing your account steadily and wiping it out in a flash.

What Is a Lot Size Calculator, Really?

A lot size calculator is your personal risk manager. It takes into account your account size, risk tolerance, and stop-loss distance to calculate the optimal trade size. Whether you’re a forex trader eyeing EUR/USD, a crypto enthusiast diving into Litecoin, or a stock market swing trader, the principles remain the same.

While many think of it as a ‘beginner’s tool,’ nothing could be further from the truth. The most experienced traders I know swear by it. Why? Because it ensures every trade is properly sized, no matter how volatile the market gets.

Going Beyond the Basics

If you’ve read about lot size calculators before, you probably know the basics: input your account balance, risk percentage, stop-loss distance, and currency pair to determine the right lot size. But there’s so much more you can do with this tool. Let’s explore some advanced scenarios and lesser-known tips to make the most of it.

Adapting to Volatility

Not all markets are created equal. The average daily range for GBP/JPY is miles apart from EUR/CHF. Using the same position sizing method for both can lead to suboptimal results. A good lot size calculator can incorporate Average True Range (ATR) or historical volatility into its calculations. This ensures you’re accounting for the unique characteristics of each asset.

Volatility and Lot Size Calculators

Volatility plays a crucial role in determining the risk level of a trade, and most lot size calculators overlook this aspect. At LotSizeCalculator.co.uk, we integrate historical volatility data to provide a detailed risk summary for each trade. Whether the trade is classified as high, medium, or low risk, this classification offers an additional layer of insight. While no trade is truly “low risk,” this summary helps traders understand potential market dynamics.

For instance, if you’re trading a high-volatility pair like GBP/JPY, our calculator will factor in these conditions and suggest adjustments, such as a wider stop-loss or a smaller lot size, to mitigate risk. We also allow users to use an ATR-based approach if they prefer, combining the benefits of volatility analysis with precise position sizing.

This feature is a game-changer for traders looking to stay ahead in unpredictable markets. Unlike other calculators that focus solely on basic metrics, ours ensures you have all the tools needed for informed decision-making.

Scaling Strategies

Another underrated application is scaling into or out of positions. Let’s say you’re trading a trend strategy and want to add to your position as the trend confirms. The calculator can help you determine the appropriate lot size for each additional entry, ensuring that you’re not over-leveraging as your exposure increases.

Hedging with Precision

For traders who use hedging strategies, knowing the exact lot size to offset risk is crucial. A lot size calculator simplifies this process, ensuring your hedge aligns perfectly with your primary position without unnecessary overexposure.

What We Offer at LotSizeCalculator.co.uk

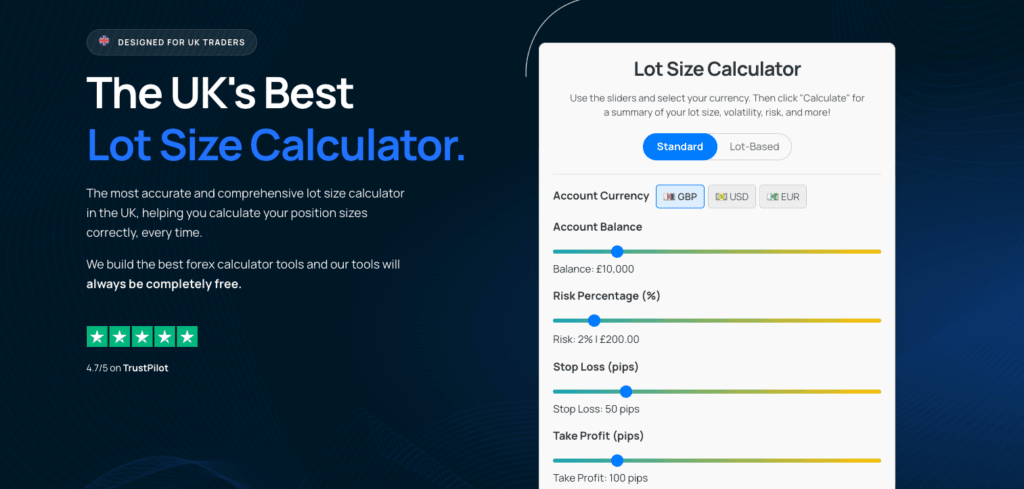

Our lot size calculator goes beyond the basics, offering a suite of features designed to empower traders of all levels. Here’s what you can expect:

Pair Information

We provide detailed summaries for each currency pair and asset, offering insights into their unique characteristics:

- EUR/USD: Depends on economic data from Europe & the US.

- GBP/USD: Can move sharply on UK data & US interest rates.

- AUD/USD: Tied to commodities & risk sentiment.

- USD/JPY: Historically volatile; watch big swings.

- USD/CAD: Correlates with oil prices; watch Canada’s economy.

- NZD/USD: May see bigger swings on commodity changes.

- USD/CHF: Can be a safe-haven; watch global risk.

- GBP/JPY: Higher volatility; bigger SL may help.

- EUR/GBP: Depends on EU & UK events; track macro data.

- XAU/USD: Gold moves on safe-haven flows & rate expectations.

- OIL: Crude oil markets shift on OPEC & global demand.

- BTC/USD: Highly volatile; track crypto sentiment.

Volatility Analysis

For each pair, we classify volatility as Low, Medium, or High based on historical data. This feeds into our risk summary feature, which evaluates the overall risk of a trade. For example:

- EUR/USD: Low

- GBP/USD: Medium

- AUD/USD: Medium

- USD/JPY: Medium

- NZD/USD: High

- XAU/USD: High

- BTC/USD: High

Customizable Risk Parameters

Our calculator lets you set:

- Account currency (GBP, USD, EUR).

- Risk percentage or fixed amount.

- Stop-loss and take-profit distances.

Dynamic Pip Values

We calculate pip values based on the selected pair and account currency, ensuring accurate position sizing every time.

Comprehensive Risk Summary

By combining volatility data, stop-loss distances, and risk amounts, we provide a final risk summary that highlights whether a trade is Low, Medium, or High risk. This summary helps traders make more informed decisions, reducing emotional bias and over-leveraging.

The Human Element: Where Calculators Fall Short

Let me share a story. Early in my trading career, I relied solely on calculators, assuming they were foolproof. One day, I input the wrong stop-loss distance—a simple typo—and ended up risking double what I intended. The lesson? Tools are only as good as the trader using them.

Here are a few human-driven pitfalls to watch out for:

- Overestimating Risk Tolerance: Calculators can’t determine how you’ll feel when the market goes against you. Be honest with yourself when setting risk levels.

- Neglecting Slippage: In fast-moving markets, the calculated risk might differ from reality due to execution delays or slippage. Always account for this.

- Forgetting Currency Conversions: If you’re trading cross-currency pairs, ensure the calculator adjusts for the base currency of your account.

Tools That Complement Lot Size Calculators

While a lot size calculator is essential, combining it with other tools can elevate your trading to the next level:

- Risk/Reward Calculators: Use these to ensure your potential profit justifies the risk you’re taking.

- Volatility Indicators: Pairing a lot size calculator with ATR can fine-tune your position sizing in volatile markets.

- Position Tracker Tools: Once your trade is live, tracking tools help you monitor your risk exposure in real-time, allowing for adjustments if market conditions change.

Crafting a Routine Around Lot Size Calculators

Building a successful trading routine often comes down to consistency. Here’s how I’ve integrated a lot size calculator into my daily workflow:

- Pre-Market Prep: Before the trading session begins, I review my watchlist and calculate potential lot sizes for setups I’ve identified.

- Execution: When a trade triggers, I double-check the calculator’s output to ensure it aligns with my plan.

- Post-Trade Analysis: After the trade, I review whether my position size was appropriate, noting any deviations or mistakes.

Real-World Applications

Let’s bring this to life with a concrete example:

- Account Balance: $10,000

- Risk Tolerance: 1% per trade ($100)

- Stop-Loss Distance: 25 pips

- Currency Pair: USD/JPY

Using a lot size calculator, the output might be 0.4 standard lots. This means that if the market hits your stop-loss, your loss will be exactly $100. Simple, precise, and stress-free.

Now, imagine you’re also trading gold and crude oil. Each asset has a different tick value and volatility profile. A good calculator will adapt to these nuances, providing tailored lot sizes for each trade.

Finding the Right Lot Size Calculator

Not all calculators are created equal. Some are basic, while others are designed for professional traders. Here are a few features to look for:

- Multi-Asset Support: If you trade beyond forex, ensure the calculator handles stocks, indices, and commodities.

- Customizable Inputs: Advanced calculators let you factor in volatility, margin requirements, and slippage.

- User Interface: The best tools are intuitive and mobile-friendly, allowing you to calculate on the go.

Conclusion: Trading Smarter, Not Harder

In trading, every edge counts. A lot size calculator may not predict market movements or guarantee profits, but it equips you with something just as valuable: control. It enforces discipline, reduces emotional decision-making, and protects your account from avoidable mistakes.

Whether you’re a day trader managing dozens of trades or a swing trader holding positions for weeks, incorporating a lot size calculator into your routine is a no-brainer. It’s not just about numbers; it’s about giving yourself the best possible chance of long-term success.

So the next time you sit down to trade, take a moment to calculate. Your future self will thank you.