How to Calculate Index Lot Sizes

Trading indices can feel like stepping into the big leagues. It’s fast, fun, and the rewards can be massive. But if you don’t understand how lot sizes work for each index, you’re not trading—you’re gambling.

If you’re anything like me, your first few trades on an index probably made you squint at the screen and think:

“Wait, why is my US100 trade risking so much?”

Or, “Why is my FTSE100 position moving slower than expected?”

It’s because calculating index lot sizes isn’t as straightforward as forex—and each index has its own quirks.

In this guide, I’ll walk you through exactly how I calculate lot sizes for popular indices like the US100 (NASDAQ), US30 (Dow), FTSE100, and GER30 (DAX). I’ll explain what makes each one behave differently, how I size my positions, and the mistakes I learned to stop making.

What is the FTSE100?

The FTSE100, often just called “the Footsie,” is the UK’s flagship index. It tracks the performance of the 100 largest companies listed on the London Stock Exchange by market cap. We’re talking household names like BP, Barclays, and Unilever, all the big businesses that dominate the UK economy.

What makes the FTSE100 unique is its tone. Compared to the American indices, it’s… calmer. More reserved. It doesn’t rip 300 points in a day like the NASDAQ. Instead, it grinds—often following global sentiment more than UK-specific news.

What It’s Called on Your Broker:

- FTSE100 (official name)

- UK100 (common on MT4/MT5)

- L100 (on some brokers)

- “The Footsie” (if you’re in a pub)

Beginners often don’t like it because it’s relatively stable and doesn’t really provide that ‘umph’ of volatility like a GBP/JPY or NAS100. But that stability can be deceptive. When the FTSE does move, it often surprises traders who thought it was “safe.”

How to Calculate FTSE100 Lot Sizes

Lot sizing on the FTSE is refreshingly straightforward… if you’re with a UK-regulated broker. You can find UK-regulated brokers for trading the FTSE on sites like Trading Brokers or Sterling Savvy. Most define:

- 1.00 lot = £1 per point

So if the FTSE moves 50 points and you’re trading 1.00 lot, you make or lose £50.

Here’s how I do it:

1. Decide how much I’m willing to risk.

Let’s say I’m risking 1% of a £10,000 account = £100

2. Set my stop loss in points.

Let’s say I’m entering at 7,900 and my stop loss is at 7,870. That’s 30 points.

3. Divide my risk by stop loss points.

£100 ÷ 30 = 3.33 lots

So I enter 3.33 into the Volume field in MT5. Simple.

Important: If your broker uses different lot sizes (like £10/point), scale accordingly. Always check their spec sheet.

What is the US100 (NASDAQ)?

The US100, often shown as NASDAQ100, is the adrenaline junkie of the indices. It’s packed with tech giants: Apple, Nvidia, Amazon, Meta. If there’s volatility in the market, the US100 is probably at the centre of it.

Unlike the FTSE, the US100 doesn’t wait around. It surges, it dips, it whips traders out of trades faster than you can say “CPI print.”

What It’s Called on Your Broker:

- US100 (on most CFD brokers)

- NAS100 or NASDAQ100 (IG, cTrader, others)

- USTech (CMC Markets)

- NDX100 (on futures)

The big attraction here is movement. This index gives you opportunities, but if you size your trade wrong, it will destroy you in seconds.

How to Calculate US100 Lot Sizes

This is where traders get wrecked. Often because they don’t check how much each lot is worth.

Most brokers offer:

- 1.00 lot = $1 per point

Let’s work it through.

1. Risk per trade:

£100 (~$125)

2. Stop loss distance:

Entry at 18,000, stop at 17,950 = 50 points

3. Risk ÷ stop:

$125 ÷ 50 = 2.5 lots

I enter 2.5 lots in MT5.

If the US100 moves 50 points against me, I’ve lost $125—exactly my risk.

BUT… some brokers use different contract sizes, where 1 lot = $5 or $10 per point. So always check and use a lot size calculator that allows you to calculate it in multiple currencies. Never assume.

What is the US30 (Dow Jones)?

The US30, aka the Dow Jones Industrial Average, is old-school. It tracks 30 major US companies: McDonald’s, Boeing, Coca-Cola, Johnson & Johnson. It doesn’t move as quickly as the NASDAQ but when it moves, each point matters.

Think of it as a heavy freight train. It takes more to get going, but once it’s rolling, it doesn’t stop quickly.

What It’s Called on Your Broker:

- US30 (most brokers)

- DJ30 or DJIA

- Wall Street (on some UK brokers)

Don’t let the “30 companies” fool you—this index still packs serious punch.

How to Calculate US30 Lot Sizes

Lot size on the Dow can trip you up, because brokers often change the value per lot.

Most commonly:

- 1.00 lot = $1 per point But sometimes, 1.00 lot = $5 or even $10 per point

Let’s say you’re using a broker where 1.00 lot = $1 per point.

1. Risk: $125

2. Stop loss: 50 points

3. Risk ÷ SL = 2.5 lots

Easy.

But if your broker uses $10/point:

- That 50-point stop loss = $500 at 1 lot So you’d only be able to trade 0.25 lots.

Lesson: Don’t trade Dow unless you know your contract size inside out.

What is the GER30 / DE40 (DAX)?

The DAX is Germany’s answer to the FTSE100… except it moves like the NASDAQ. It’s fast, sharp, and brutally efficient. The index tracks 40 top German companies (it used to be 30, hence the GER30 name).

What It’s Called on Your Broker:

- GER30 (older name, common on MT4)

- DE40 (new name, for 40 companies)

- DAX or DAX40 (officially)

It opens with a bang (literally, the cash open at 8 AM UK time is madness). You don’t casually place a DAX trade. You plan it, watch it, and respect it.

How to Calculate DAX Lot Sizes

Like NASDAQ, this depends on broker setup. Most offer:

- 1.00 lot = €1 per point

Let’s go:

1. Risk: €125 (~£100)

2. Stop loss: 25 points

3. Risk ÷ SL = 5 lots

So you’d enter 5.00 lots.

But again—some brokers set 1 lot = €5 or €10 per point. So make sure you know what your exposure is before pressing “Buy.”

Also worth noting: the DAX can move 100 points in 15 minutes on a news day. Always use stops. Always calculate lot size with care.

What is the US500 (S&P 500)?

This is America’s real stock market benchmark. The S&P 500 tracks the top 500 companies by market cap. It’s more balanced than the NASDAQ, less erratic than the Dow, and arguably the best “sentiment” index.

What It’s Called on Your Broker:

- SPX500

- US500

- S&P500

- Standard & Poor’s 500

It trends beautifully and is often favoured by swing traders who want smoother moves and less noise.

How to Calculate US500 Lot Sizes

Most brokers use:

- 1.00 lot = $1 per point

Let’s say:

Risk = $100

Stop = 20 points

Then:

$100 ÷ 20 = 5.00 lots

This one’s straightforward, but don’t underestimate the speed at which this index can accelerate on Fed days.

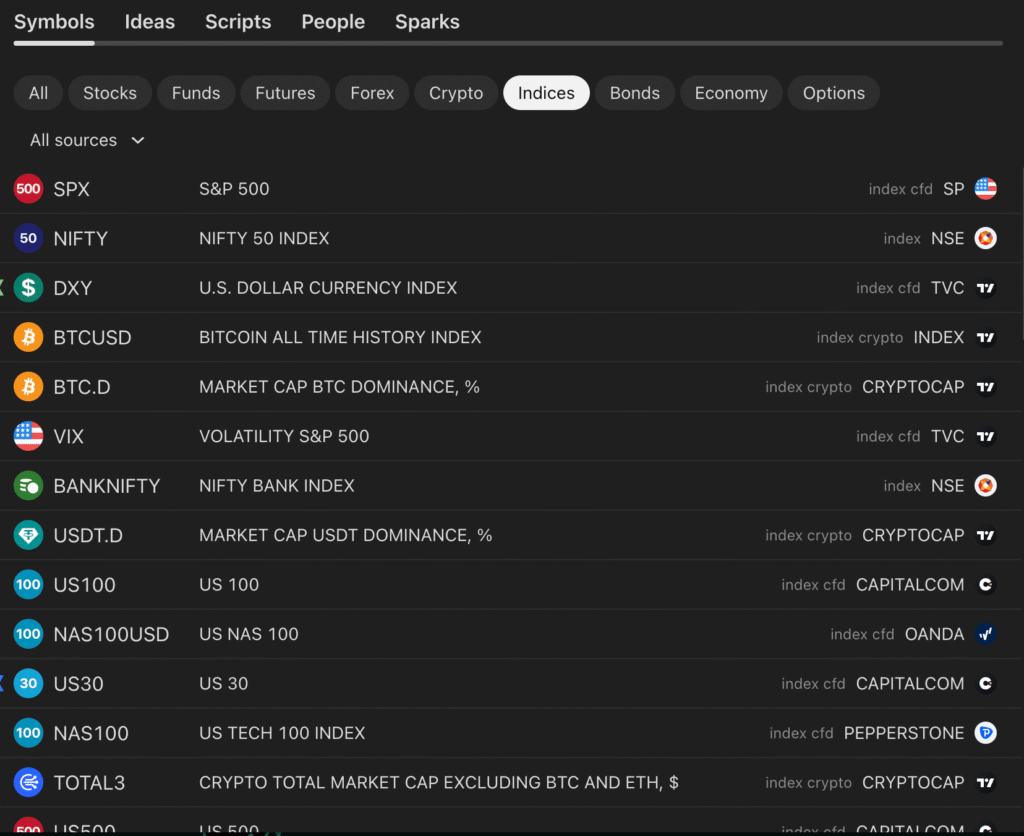

What About JP225, HK50, and Other Indices?

You might see:

- JP225 (Nikkei) – trades overnight if you’re in the UK, strong trends but wild gaps

- HK50 (Hang Seng) – fast, volatile, not beginner-friendly

- CHINA50 – heavy slippage, big spikes around Asian session opens

For these, lot sizes vary massively. Always go to your broker’s symbol spec page and find:

- Contract size

- Point value

- Tick size and tick value

Then use that info with a proper calculator to stay safe.

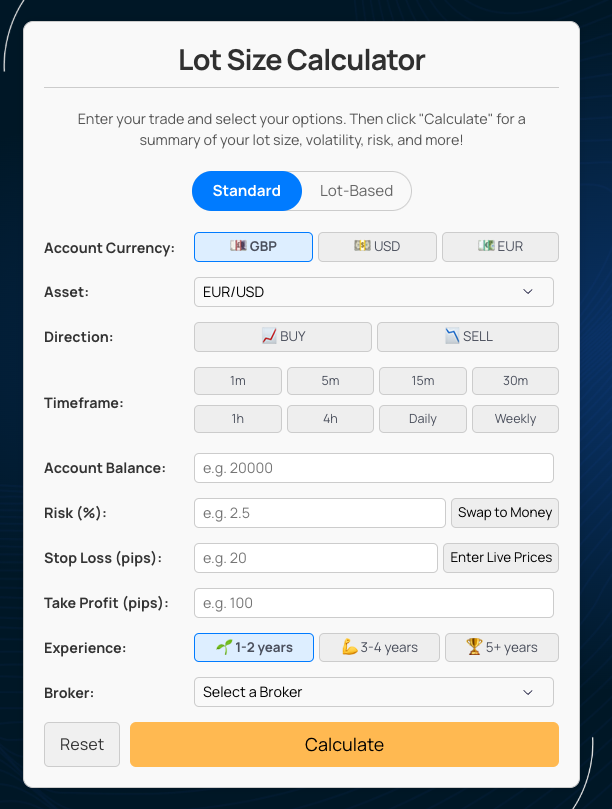

Why I Always Use a Lot Size Calculator

I’m not going to lie, there’s a bit of ego at the start. You think, “I don’t need a calculator. I know how to trade.” Then you size a US30 trade wrong and lose 4% in two minutes.

That’s why I now use a lot size calculator every time I place an index trade.

Here’s why it works for me:

✅ Supports indices, forex, stocks, crypto

✅ Lets me enter stop loss in points, price, or pips

✅ Shows risk, position size, and exact lots

✅ Easy to switch between asset classes

✅ Doesn’t make me feel like I’m filling in a tax return

Final Thoughts on Sizing for Indicies

Trading indices is exhilarating, but they’re unforgiving. They don’t give you second chances if you’re careless.

So forget the formulas for a minute. Remember this:

- Understand the index you’re trading

- Know what each lot actually means

- Decide how much you’re willing to lose before you enter

- And never, ever assume the lot value is “probably the same as last time”

Master your lot size & manage your risk first, and everything else gets easier: entries, exits, confidence, consistency.