If you’re dipping your toes into the world of trading—whether it’s forex, CFDs, or other markets—you’ll hear the word “lot” thrown around a lot. (See what I did there?) But what exactly is a lot, how do you pick the right size, and why does everyone talk about micro, mini, and standard lots like they’re different flavours of ice cream? Let’s break it all down.

What is a lot?

In trading, a “lot” is simply the standard unit size of a trade. Think of it like a packet of biscuits: if you buy a “packet,” everyone knows how many biscuits you’re getting. In the trading world:

- 1 standard lot usually represents 100,000 units of the base currency in forex.

- 1 mini lot is 0.1 of a standard lot (10,000 units).

- 1 micro lot is 0.01 of a standard lot (1,000 units).

The numbers can feel a bit random at first, but it’s essentially a universal way to measure how big or small your trade is. Trading with a standard lot means much larger potential profits—or losses—per pip than trading with a mini or micro lot.

Why lot size matters for beginners

Choosing the right lot size is crucial for risk management. Imagine if you bet on a horse race with your entire life savings for a single bet; you’d be sweating bullets! The same goes for trading. If your lot size is too big, a small adverse market move could wipe out a huge chunk of your account. If it’s too small, you might not meet your trading goals—though being too conservative is rarely as dangerous as being overly aggressive.

Most experienced traders suggest not risking more than 1–2% of your account on any single trade. This keeps you in the game longer, even if you encounter a rough patch (which, let’s face it, happens to everyone).

Micro lots vs mini lots vs standard lots

- standard lot (1.0): 100,000 units of currency. Typically moves the account balance faster (both up and down).

- mini lot (0.1): 10,000 units, or one-tenth of a standard lot. Often the sweet spot for moderately sized accounts.

- micro lot (0.01): 1,000 units, or one-tenth of a mini lot. Great for beginners or those with small accounts.

OK, quick caveat here, some brokers don’t explicitly label them as “micro” or “mini” accounts anymore. Instead, you’ll just type in 0.1 for a mini lot or 0.01 for a micro lot when placing a trade. If your broker only shows standard lots, you can still usually enter these decimal values.

How do I calculate my lot size?

Let’s say you want to risk 2% of your account per trade. Here’s a straightforward formula many traders use:

Lot Size=Risk per Trade in £Stop Loss (in pips) ×Pip ValueLot Size=Stop Loss (in pips) ×Pip ValueRisk per Trade in £

- Risk per Trade in £: This is how much you’re willing to lose if the trade goes against you (2% of your account, for instance).

- Stop Loss (in pips): The distance between your entry price and your stop-loss price.

- Pip Value: How much each pip is worth per standard lot in the particular currency pair or instrument you’re trading.

OK this was crazy complicated, but if you are looking for a quick way, just use a lot size calculator like the one we offer on our site. If you are trying to do this manually then once you calculate a “Lot Size” with this formula, you can adjust your trade size up or down to match something like 0.01 (micro), 0.05, 0.1 (mini), 1.0 (standard), etc.

Beginners guide to Lot Sizing

Below is a rough guide to help you see how a 2% risk might play out for different account sizes. We’ll assume your stop loss is consistent (for example, 20 pips), and the pip value for your currency pair is about £1 per pip for a 0.1 lot (mini lot). This is just an example—pip values can change based on the pair you trade.

| account size | 2% risk in £ | example stop loss (pips) | recommended lot size (approx) | notes |

|---|---|---|---|---|

| £100 | £2 | 20 pips | 0.01 (micro) | Very small account; keep risk ultra-low. Possible to trade micro lots so each pip is worth ~£0.10. |

| £1,000 | £20 | 20 pips | 0.10 (mini) | A mini lot might be okay if each pip ~£1. But if you’re very new, you could even do 0.05 or 0.02 for extra caution. |

| £5,000 | £100 | 20 pips | 0.50 (half mini) or 0.50 total lots | You can scale up slightly. Possibly do half a mini lot (0.50) so each pip is worth ~£5. Keep an eye on total risk. |

| £10,000 | £200 | 20 pips | 1.0 (standard) | Now you’re getting into standard lot territory, each pip ~£10. Could also consider 0.5 or multiple positions. |

This table is just to illustrate the principle and is 100% not advice – lot sizing depends on your tolerance level and how comfortable you feel at your account size. Also, always double-check your broker’s exact pip values because they can vary by currency pair. For example, GBP/JPY will have a different pip value than EUR/USD if you’re calculating in pounds.

Best lot size for beginners in the UK

Given typical UK broker platforms and the 2% risk rule, you’ll likely want to stick to micro or mini lots in the beginning. If your account is under £1,000, micro lots (0.01 or 0.02) are your friend. Even a 20–30 pip loss won’t make you break a sweat. Once your account grows or you become more experienced, you can gradually increase to bigger lot sizes.

- for a £100 account: Micro lots (0.01) are almost mandatory if you want to stay within 2% risk.

- for a £1,000 account: Mini lots (0.10) might be doable for a 2% risk, but you could still do smaller increments like 0.05.

- for a £5,000 account: You can consider placing 0.5 or 1.0 lot trades, depending on your stop loss. But staying on the conservative side is often wise until you gain confidence.

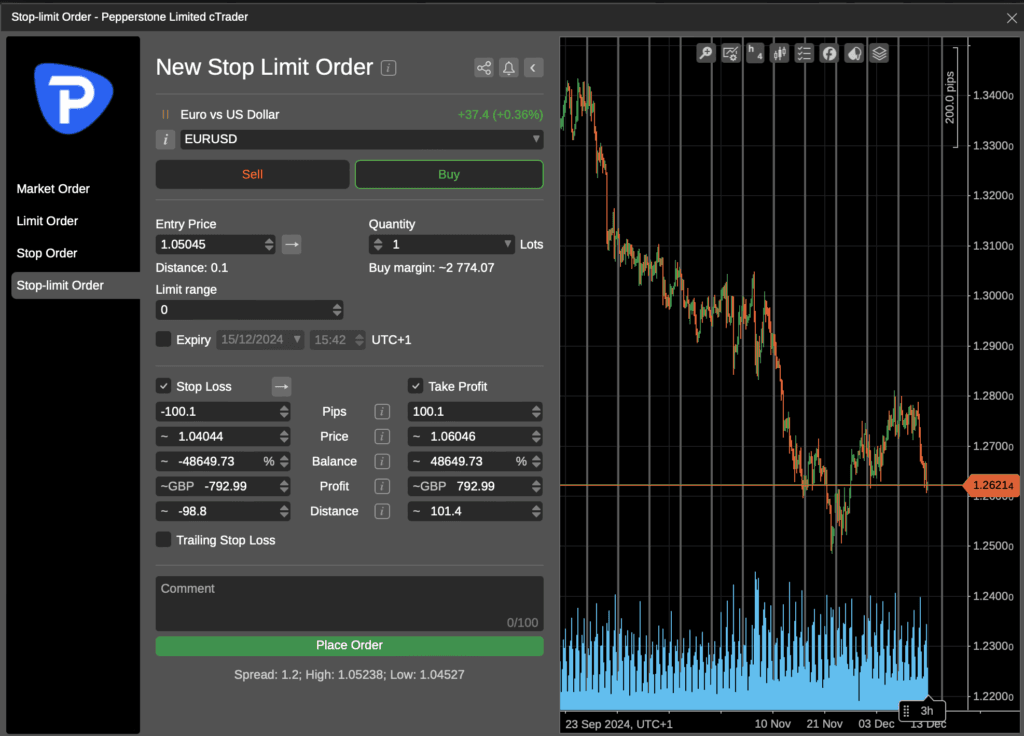

Why micro and mini lots aren’t always obvious

You might open a trading platform and see “1.0” as the default lot size, which typically stands for a standard lot (100,000 units). Don’t panic! You can usually click into that field and change it to 0.1 (mini lot) or 0.01 (micro lot). Sometimes the platform’s wording can be confusing, but as long as it accepts decimals, you should be able to place a much smaller trade.

Tips for managing your lot sizes

- use a lot size calculator: Plenty of free online calculators exist. You punch in your account size, desired risk percentage, and stop loss, and the calculator tells you the recommended lot size. No guesswork required.

- think about your stop-loss distance: The closer your stop loss, the larger your position can be for the same amount of risk. Conversely, if your stop loss is far away, you’ll need a smaller lot size.

- start small, build confidence: Especially if you’re new, it’s better to err on the side of caution. Smaller lot sizes mean smaller potential losses if you’re still learning the ropes.

- stick to your plan: Don’t randomly change your lot size out of greed or panic. Consistency is key, and big swings in position sizing can lead to emotional trading errors.

putting it all together

Here’s a final table summarising the typical lot sizes and their approximate risk levels. Just remember, the exact risk depends on your stop loss and the pip value, but this should give you a decent ballpark:

| lot size | units of currency | typical pip value on major pairs* | suitable for (assuming ~2% risk) |

|---|---|---|---|

| 1.0 | 100,000 | ~£10 per pip | Accounts > £10,000+ (depending on stop loss) |

| 0.1 | 10,000 | ~£1 per pip | £1,000+ accounts (mini) |

| 0.01 | 1,000 | ~£0.10 per pip | Smaller accounts (micro) |

*Approximate pip value if your account is in GBP and you’re trading something like GBP/USD or EUR/USD. Always confirm your broker’s actual pip values.

Summary

Choosing the right lot size can make or break your trading experience—especially when you’re just starting out. By sticking to a 1–2% risk rule, using micro or mini lots initially, and regularly checking a lot size calculator (or using the simple formula we shared), you’ll be in a much better position to preserve capital and learn the markets without heart-stopping losses.

The key is to stay patient and keep your risk low. You can always increase your lot size as you gain confidence and your account grows. Think of it like building up your stamina for a marathon: no one expects to run 26 miles straight off the bat without any training. So be kind to yourself, protect that bankroll, and remember—the slow and steady approach often wins the trading race. Good luck out there!