What’s the deal with lot size calculators on TradingView?

I’ve been poking around TradingView for a while now, checking out different scripts and indicators to help me manage my trades. Inevitably, I started experimenting with various “lot size calculator” scripts. If you’re trading forex or CFDs, you already know how crucial it is to get your position sizing right—yet doing all the maths in your head every single time can be a real chore. So, let’s talk about some of the more popular lot size calculators I’ve found and how they stack up vs our lot size calculator, how they stack up, and which might be worth adding to your chart.

Below, I’ll walk you through my experience with five of the best scripts currently floating around TradingView.

Think of it like a friendly tour guide, not a hardcore product review—though I’ll give you my honest impressions. After we size up these community tools, we’ll jump into a detailed (but hopefully still fun) breakdown of how to build your own lot size calculator in Pine Script (if you want total control).

The top 5 lot size calculators I’ve tried (and what I think)

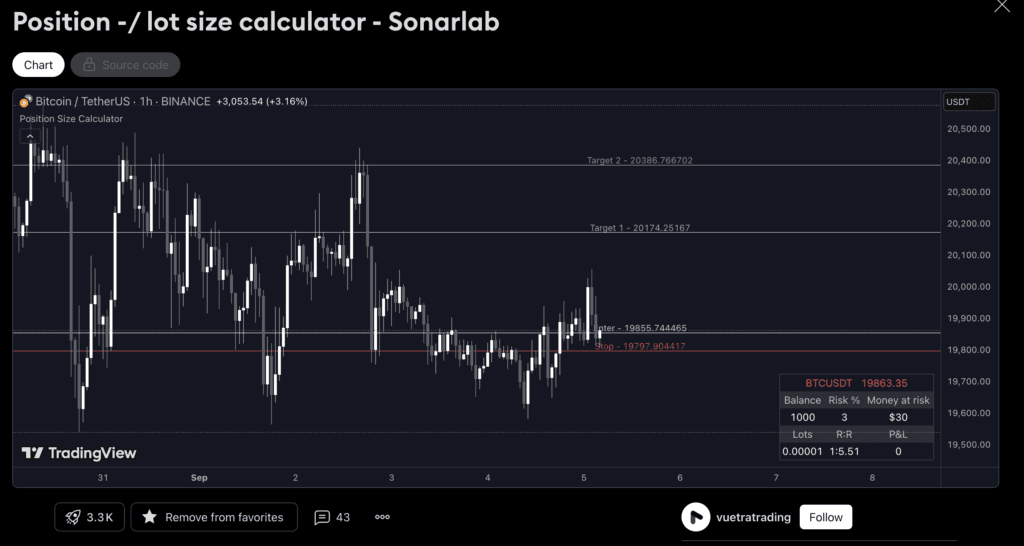

1. Position -/ lot size calculator – sonarlab (vuetratrading) [3.3K users]

- Vuetratrading tradingview calculator.

- first impression: This is the script with the highest reported user count, which naturally made me curious. It’s pitched as a comprehensive position-sizing solution, and from my initial exploration, it lives up to that description.

- what i liked: It has a clean interface and it updates in real time as you move your stop-loss lines. If you’re the type of trader who’s always adjusting your stop by a pip here or there, it’s handy to see the required lot size respond instantly.

- the caveats: It can feel slightly “heavy” if your chart is already loaded with indicators (especially like pivot points as it looks like them!). Also, a few people mention that advanced features (like partial close calculations) are not fully integrated. But overall, it’s a powerhouse for straightforward lot size calculations.

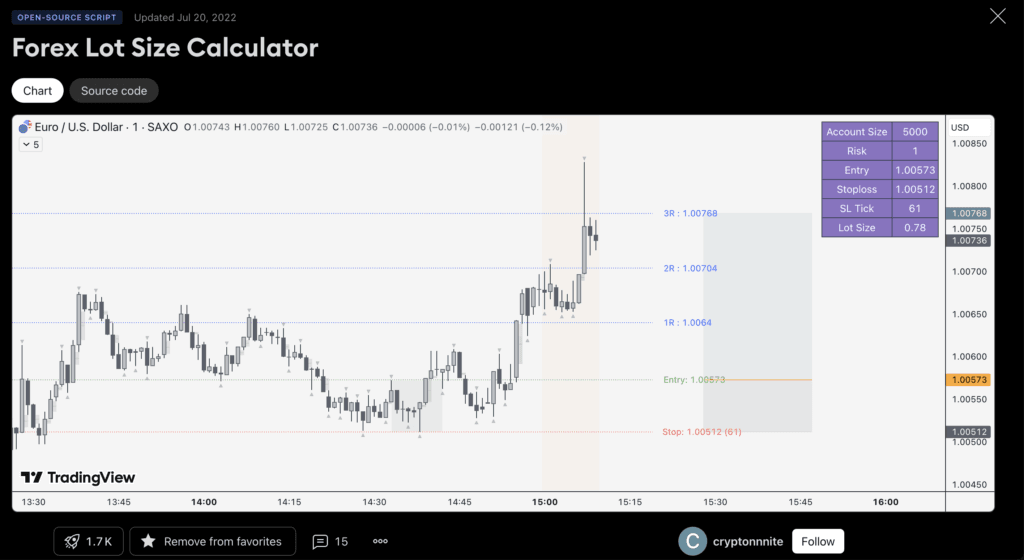

2. Forex lot size calculator – cryptonnite [1.7K users]

- Cryptonnite tradingview calculator

- first impression: This one focuses heavily on forex pairs and tries to account for different pip values among various currencies. A big plus if you trade cross pairs or exotics.

- what i liked: I liked the clarity in its “About” section—cryptonnite gives a quick tutorial on how they handle pip values, so you’re not left guessing if it works for your favourite pair.

- the caveats: You do have to manually input or adjust certain fields if you switch from, say, GBP/USD to EUR/JPY. A truly universal solution for all pairs is tough to find, though, so I’m not faulting them too much for that.

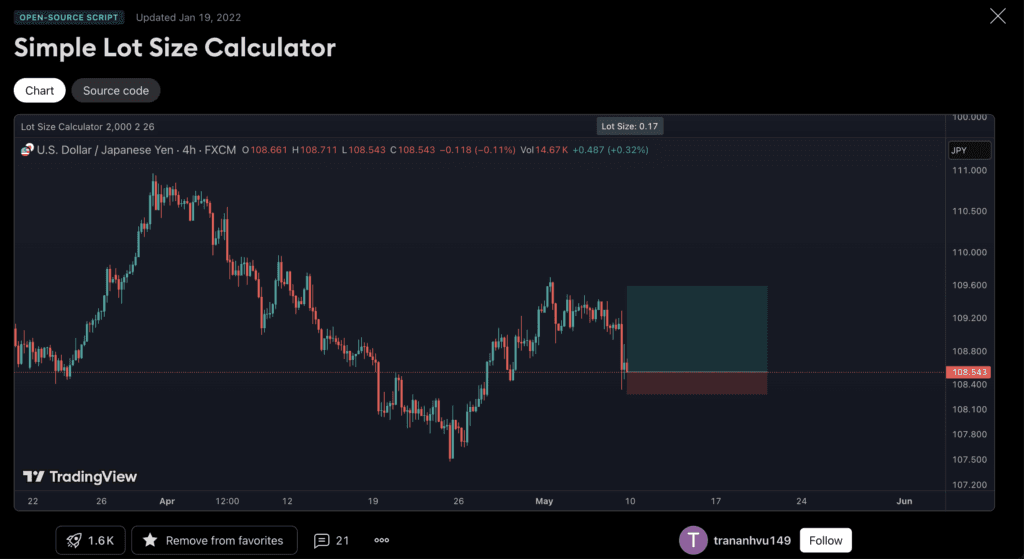

3. Simple lot size calculator – trananhvu149 [1.6K users]

- first impression: The name says it all: “Simple.” This script aims to do one job—help you figure out how many lots to trade—and does it without a bunch of extra bells and whistles. To top all off – this guy is a bit of a legend with only one script to his name – it seems like hes just dedicated to doing one job.

- what i liked: It’s super user-friendly. The UI is minimal, and the instructions are easy to follow. If you’re brand-new to TradingView scripts, you won’t be confused by dozens of toggles and inputs.

- the caveats: Being simple can also be limiting. If you want multiple partial take-profit calculations or advanced risk management features, you may feel it’s a bit underpowered. But, hey, for a quick lot size check, it does the trick.

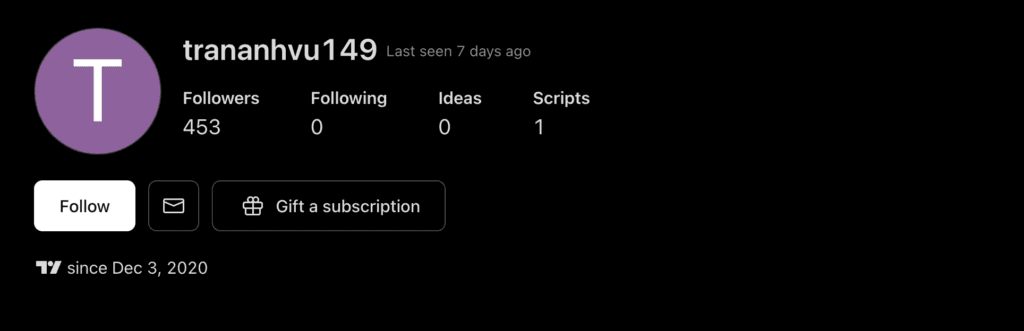

4. Position & lot size calculator – hanabil [1.3K users]

- first impression: Another solid contender, with a few extra touches. The script’s creator, hanabil, seems active in the community, which is always a good sign.

- what i liked: I liked how it visually shows your risk in pips vs. your expected account drawdown. It’s a nice way to see, at a glance, if you’re risking too much (or too little).

- the caveats: Some advanced features (like integrated multi-currency detection) appear to be either missing or planned for future releases. Still, if you mostly stick to a couple of major pairs, it’s fine.

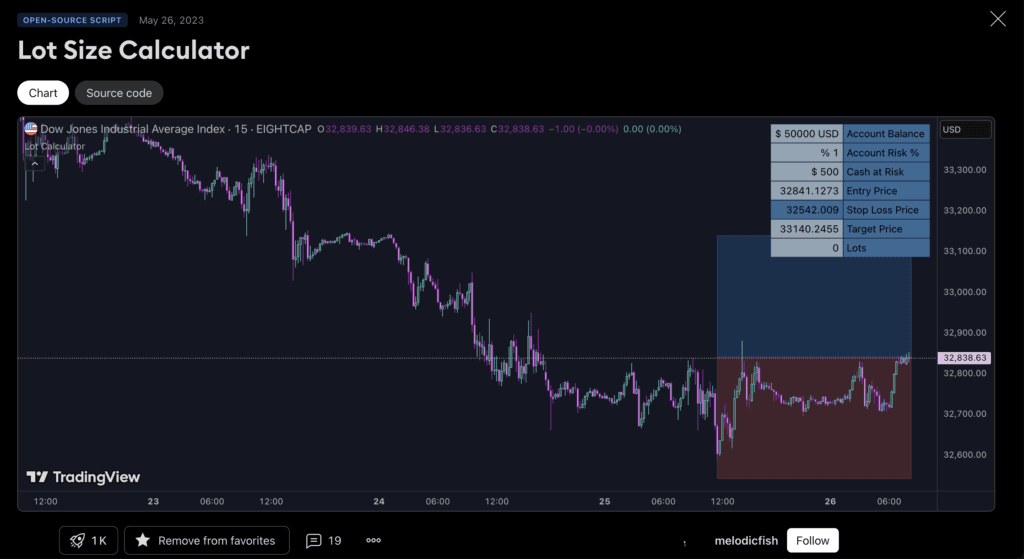

5.Lot size calculator – melodicfish [1K users]

- first impression: Yet another script that tries to keep it straightforward. “melodicfish” offers basic settings for account size, risk percentage, and stop-loss pips.

- what i liked: Despite being “another lot size calculator,” it has a pleasant design and is pretty intuitive. I also like that it doesn’t hog screen real estate.

- the caveats: It’s not automatically updated for different pair pip values, so if you’re a multi-pair fiend, you’ll need to tweak inputs accordingly. There’s also no fancy stuff like partial close or trailing stops included.

Would I say one stands heads and shoulders above the rest? Honestly, they each have their strengths—and a lot depends on what you want. If you’re all about a single major pair, the simpler calculators might be enough. If you jump around different currencies, you may appreciate the more advanced scripts that account for pip value variations. And if you love extra visual cues and real-time updates, you might lean toward something like the Sonarlab or cryptonnite solutions.

Either way, it’s nice to see there are plenty of free, community-driven scripts to handle what can be a tedious calculation. Still, there’s always the possibility of wanting more.

paid or closed-source scripts

On TradingView, you might come across “invite-only” scripts or premium indicators that promise advanced risk management features. These can be enticing if they offer more than just a basic calculation—like multiple partial take-profit calculations, currency conversion, or integration with other strategies. However, the biggest downside is that you can’t peek into the code to verify it’s doing what it claims.

pros: Often come with extra bells and whistles, such as built-in trade management panels and professional design.

cons: Costs can be steep. Also, you must rely on the developer’s reputation and support, since you can’t verify the logic.

What makes calculators good vs bad?

So how do you figure out if a particular lot size calculator script on TradingView is worth your time—or if it’s a dud?

1. Transparent, well-documented code

Good scripts often have detailed “About” sections explaining exactly how the calculation is performed. If the script is open-source, you can dive in to see the code in Pine Script. If the code looks well-structured and commented, that’s a great sign.

2. Updates and community feedback

Check the comments or any user reviews. If the script author is active and addressing questions or bugs, that’s another green flag. If you see negative feedback about inaccuracy or no response from the creator, proceed with caution.

3. Accuracy across different instruments

The best calculators factor in each pair’s pip value, or at least prompt you to specify it. If you’re only trading GBP/USD, it’s simple. But if you also trade exotic pairs or metals, be sure the script can handle that.

4. User-friendly interface

A good script doesn’t have to be jam-packed with features, but it should be easy to input your account balance, your risk percentage, and your stop-loss distance without fiddling with complicated settings.

5. Regular disclaimers and risk warnings

Serious authors will remind you that a lot size calculator is just a tool—and that risk management is still your responsibility. If a script claims “guaranteed profits,” that’s a huge red flag.

6. Version history

TradingView scripts have version logs if the author updates them. Check if the script has been updated recently. A stale script from 2020 might still work, but it could also be missing important improvements found in newer versions.

Build your own TradingView Lot Size Calculator

OK the easiest way here, before you dive into my code – is to do it with a bit of help from ChatGPT as you will nearly almost get good code from the o1 model when i’m writing this in Feb 2025…(at least from what I found).

OK with that out the way let’s have a look at how you build one:

Build your own: a step-by-step guide

- set up your pinescript

Fire up TradingView, and in any chart, click the Pine Editor tab at the bottom. Click “New” to start a fresh script. TradingView will generate a default template for you. It might look something like this:

plaintextCopyEdit// This is a placeholder, for example:

@version=5

indicator(title="My Custom Lot Size Calculator", shorttitle="LotCalc", overlay=true)

Use @version=6 to use the latest Pine Script version. We also set overlay=true so our calculations can be displayed directly on the chart.

- define the user inputs

We want to let the user specify their account size, their risk percentage, and their stop-loss distance. You can create these as Pine Script “inputs”:

pineCopyEdit//@version=5

indicator(title="My Custom Lot Size Calculator", shorttitle="LotCalc", overlay=true)

// User Inputs

var accountSize = input.float(1000.0, title="Account Size (£)")

var riskPercent = input.float(2.0, title="Risk (%)")

var stopLossPips = input.float(20.0, title="Stop Loss (pips)")

Here, input.float allows the user to type in values. The defaults shown are just examples.

- calculate the recommended lot size

Use:

javaCopyEditLot Size = (Risk in £) / (Stop Loss in pips * Pip Value)

- Risk in £ =

(riskPercent / 100) * accountSize - Pip Value depends on the currency pair. If you’re using GBP as your account currency and trading GBP/USD, 1 mini lot might have a pip value of ~£1. But it varies.

pineCopyEdit// Additional user input for pip value

var pipValue = input.float(1.0, title="Pip Value (£ per pip for 0.1 lot)")

// Calculations

var riskInPounds = (riskPercent / 100.0) * accountSize

// Now let's assume the user is referencing a mini lot's pip value

var lotSize = riskInPounds / (stopLossPips * pipValue)

- displaying the result

Now that we havelotSize, we want to show it on the chart. A simple approach:

pineCopyEdit// Display on the chart

label.new(bar_index, high, "Recommended Lot Size: " + str.tostring(lotSize, format.mintick), style=label.style_label_up)

This places a label at the top of the chart (near the current bar’s high) with the recommended lot size.

- refinethe code

If you want the label to update only once per bar, you might enclose it in anif barstate.islastcondition. Here’s a more cohesive script:

pineCopyEdit//@version=5

indicator(title="My Custom Lot Size Calculator", shorttitle="LotCalc", overlay=true)

// User Inputs

accountSize = input.float(1000.0, title="Account Size (£)")

riskPercent = input.float(2.0, title="Risk (%)")

stopLossPips = input.float(20.0, title="Stop Loss (pips)")

pipValue = input.float(1.0, title="Pip Value (£ per pip for 0.1 lot)")

// Calculations

riskInPounds = (riskPercent / 100.0) * accountSize

lotSize = riskInPounds / (stopLossPips * pipValue)

// Round the lot size to 2 decimal places

roundedLot = math.round(lotSize * 100.0) / 100.0

if barstate.islast

label.new(bar_index, high, "Recommended Lot Size: " + str.tostring(roundedLot), style=label.style_label_up)

- test your script

- Save your script, then click “Add to Chart.”

- Check if the label updates as you alter the inputs.

- Switch between different pairs to confirm if your pip value assumption works or needs adjusting.

Potential issues we found

Here are some issues that we encountered when building out own lot size calculator:

- pip value assumptions: Not all pairs have the same pip value. If you actively switch between, say, EUR/USD and GBP/JPY, you’ll have to handle that.

- lack of real-time broker integration: Even if your script calculates the perfect lot size, you still need to type that into your broker’s platform.

- missing advanced features: This basic script doesn’t handle partial closes, multiple entries, or trailing stops. You can add those if you want to code some more!

- market volatility: Slippage can mean you don’t get filled exactly where you expect, so your actual risk might differ slightly from the script’s calculation.

How to customise your calculator

You can actually do a lot more with this than we’ve just outlined to make it even better:

- detect the currency pair automatically: Use

syminfo.basecurrencyorsyminfo.currencyto dynamically adjust pip value. - risk-to-reward ratio: Let the user define a R:R ratio (e.g., 1:2) and visually plot potential take-profit lines.

- multiple exit levels: If you close half at 1:1 and half at 1:2, code it in.

- table-based interface: Instead of labels, build a floating table that sits in the corner of your chart.

Is building your own worth it?

Hmm… from our experience no.The free ones are pretty darn good but here are some pros and cons of building your own:

- pros: Full control, zero reliance on third-party updates, and you learn some Pine Script along the way.

- cons: It’s time-consuming, especially if you want advanced features. If you’re not into coding, a well-reviewed script might be easier.

Frequently asked questions

- Can i trust community scripts for risk management?

Generally, yes—if they’re open-source and have good feedback. But you should still do your due diligence. - Why do pip values vary?

Different currency pairs have different quoting conventions. JPY pairs, for example, often have two decimals, while EUR/USD typically has five. - Can i integrate broker data for an exact pip value?

Not automatically. You’d need a bridging solution or an external API. - Do i need a separate lot size calculator if i use mt4 or mt5?

If you place trades on MetaTrader, you might have built-in or EA-based options. But for those who do analysis on TradingView, an integrated script can be very handy. - What if i ignore risk management altogether?

You risk blowing your account, especially in a streak of losses. Position sizing is everything, folks!

Summary

It’s pretty awesome to see how the TradingView community steps up to provide these lot size calculators for free to help everyone manage risk more effectively. Whether you choose one of the five popular scripts I mentioned, or you go the DIY route with Pine Script, I just wanted to add my two-cents to the discussion on TradingView calculators as some are actually really useful.

Remember, though, a calculator is just that—a calculator. Ultimately, it’s your job to set a sensible stop-loss, decide your risk percentage, and confirm that you’re comfortable with the potential drawdown. But these scripts can save you heaps of time and keep you from making silly mistakes.