As you know by now, if you’ve hung around on our site long enough, position sizing and by extension calculating your position size, is one of the most overlooked yet critical aspects of trading. If you’ve ever found yourself wondering why your account is swinging wildly despite using a solid strategy, chances are your position sizing is off.

Getting it right is not just about plugging numbers into a lot size calculator like ours—it’s about understanding risk, capital allocation, and trade management in a way that suits your style of trading. By calculating your position size manually, you take full control over your risk, protect your capital, and optimize your returns without relying on rigid, one-size-fits-all rules.

Many traders stick to the generic 2% rule, which is often repeated as gospel. While it’s a reasonable starting point, blindly following it without considering volatility, asset class, or your own risk tolerance can be a mistake. Here’s why.

Why Position Sizing Can Make or Break Your Trading Career

Risk management is what separates professional traders from gamblers. Every trader experiences losing streaks, but the best ones survive—and thrive—because they know how to control risk. Without proper position sizing, even a good trading system can fail due to uneven risk exposure. Some trades might be too large, leading to unnecessary losses, while others might be too small, limiting profit potential. Striking the right balance is key.

Getting your position size right prevents account blow-ups, stabilizes returns, and reduces emotional trading. When you know your risk before entering a trade, you’re less likely to make impulsive decisions. Calculating position size manually gives you the confidence to execute trades systematically, without second-guessing yourself every time the market moves against you.

The Key Elements in Position Sizing

Before you can calculate your position size, you need to understand a few critical variables / terminology related to trading, so here’s a quick intro. If’t it’s not your first time, you can skip this part:

Account Balance

The total amount of money in your trading account. This is what ultimately determines the overall size of your trades and how much you can afford to risk. Fairly standard stuff here.

Risk Per Trade

This is the percentage of your account balance you’re willing to lose on a single trade. Most professional traders risk between 0.5% and 2% per trade. A lower percentage helps preserve capital during losing streaks, while a higher percentage can accelerate growth but increases the risk of large drawdowns.

Stop-Loss Distance

The difference between your entry price and stop-loss price. This is measured in pips (for forex), points (for stocks and futures), or dollars per share (for stocks). A wider stop-loss means a smaller position size, whereas a tighter stop-loss allows for a larger position. However, this really is a double-edged sword as you don;t want to be too close or too far so balance is key here.

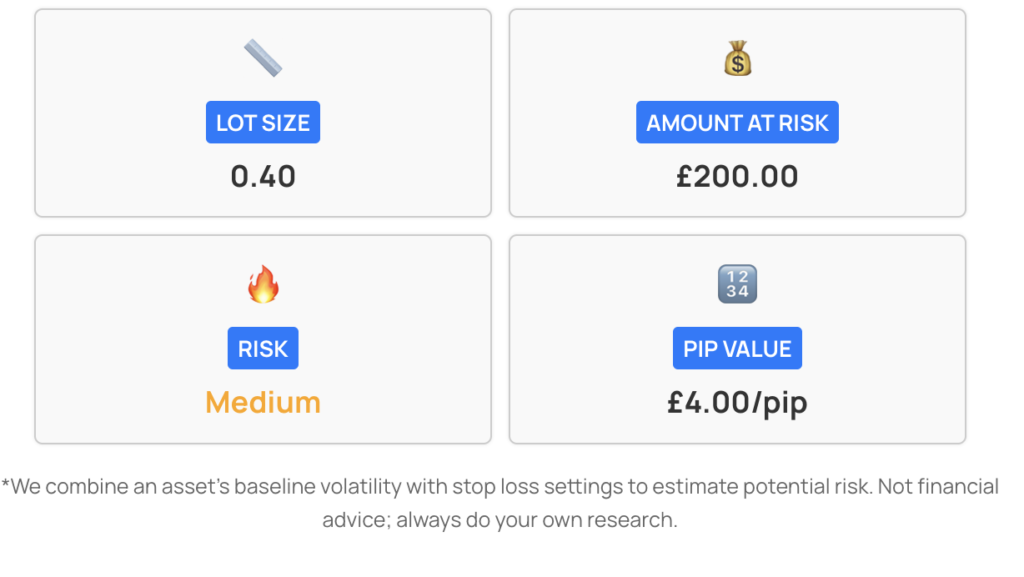

Pip/Point Value

This is the monetary value of each pip or point movement in your chosen asset. We actually provide this as part of our calculation anyway – see below. It varies depending on the market and the instrument you’re trading. Understanding how much a price move affects your trade value is essential for accurate position sizing.

Leverage (For Forex & Futures)

Leverage amplifies your position size, allowing you to control a larger trade size than your account balance would normally permit. While this can increase profits, it also magnifies losses, making proper position sizing even more critical.

Volatility Adjustments

Markets are not static. Some assets are more volatile than others, and even the same asset can experience different volatility levels depending on market conditions. Many traders use the Average True Range (ATR) indicator to adjust their position sizes dynamically based on current volatility.

Now we’ve got a handle on the basics, let’s apply these to different markets.

How to Calculate Position Size for Forex Traders

Forex trading requires precise lot sizing to align risk with your strategy. Since forex pairs are quoted in pips, you need to determine the pip value for your chosen pair before calculating your lot size.

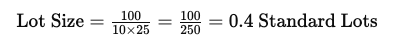

Forex Position Size Formula

Example: Trading EUR/USD

Let’s assume the following:

- Account Balance: £10,000

- Risk Per Trade: 1% (£100)

- Stop-Loss Distance: 25 pips

- Pip Value: $10 per pip (for a standard lot)

Now, we apply the formula:

This means you should enter the trade with 0.4 lots to ensure that if your stop-loss is hit, your loss will not exceed £100.

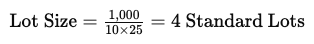

If your account was larger, say £50,000, and you decided to risk 2% per trade, your risk amount would be £1,000. Adjust the formula accordingly:

How to Calculate Position Size for Stock Traders

Stock traders calculate position size based on the dollar / pound amount risked per share. The number of shares purchased should be proportionate to the total risk per trade.

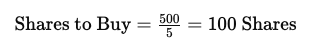

Stock Position Size Formula

Example: Trading Apple (AAPL)

- Account Balance: £50,000

- Risk Per Trade: 1% (£500)

- Entry Price: £150

- Stop-Loss Price: £145 (risk per share = £5)

Apply this formula:

If AAPL’s volatility increases, requiring a £10 stop-loss, then your position size would decrease to 50 shares to maintain the same dollar risk.

How to Calculate Position Sizes for Futures Traders

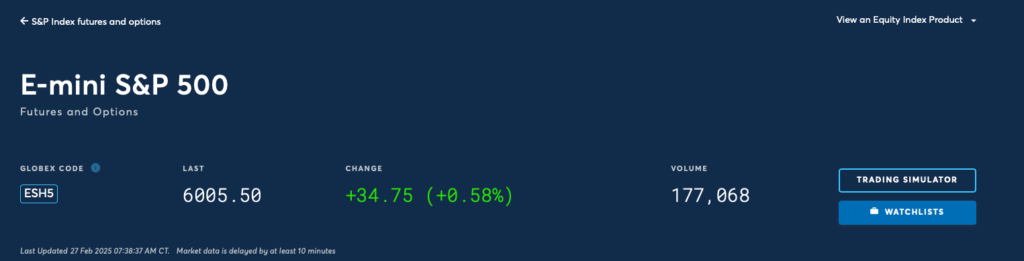

Futures traders need to account for standardised contract sizes and tick values. Futures contracts have predefined price movements per tick, so traders need to adjust their position size accordingly. We’ve chosen E-mini futures as they are one of the most commonly traded futures contracts in the world – not because you may have a particular interest in them so adapt this as you wish.

Futures Position Size Formula

Example: Trading E-mini S&P 500 (ES) Futures

- Account Balance: £20,000

- Risk Per Trade: 2% (£400)

- Tick Value: £12.50 per tick

- Stop-Loss Distance: 16 ticks (4 points)

This ensures that if the market moves against you by 4 points, you only lose £400, which is 2% of your capital.

Final Thoughts

If there’s one thing you should take away from this whole little rant of mine, it’s that consistent position sizing is more important than your win rate and vital to keep an eye on if you plan to trade professionally. Many professional traders only win around 40-50% of their trades, yet they remain profitable because they control risk effectively. By taking the time to calculate your position sizes properly, you give yourself the best chance to survive and thrive in the markets. So, refine your calculations, stay disciplined, and remember—position sizing is your best defense against uncertainty in the markets.