If you’ve ever been overwhelmed by the sheer number of trading tools out there, you’re not alone. From charting platforms like TradingView and Ninja Trader to automated trading bots, there’s no shortage of shiny gadgets claiming to revolutionize your trading. But let’s get real for a moment—most traders don’t need an endless arsenal of tools. What you do need is a handful of reliable, easy-to-use resources that actually make your life easier. And one of the most underrated tools in your kit? The humble lot size calculator.

Now, before you roll your eyes, hear me out. A lot size calculator might not sound glamorous, but it’s a game-changer for anyone serious about managing risk and trading with confidence. But not all lot size calculators are created equal. So, how do you pick the right one? Let’s dive in.

Why Trading Tools Matter

Let’s start with the big picture: trading tools. Whether you’re dabbling in forex, trying your hand at crypto, or exploring commodities, the right tools can be the difference between a chaotic experience and a controlled, disciplined approach.

Take charting platforms like TradingView, for example. It’s intuitive, packed with customizable indicators, and lets you collaborate with other traders. Then there are position sizing tools that save you from the mental gymnastics of calculating risk on the fly. These tools aren’t just “nice to have”—they’re essential.

A good trading tool does three things:

- Simplifies your process: It’s easy to use and doesn’t overcomplicate things.

- Reduces errors: By automating repetitive tasks, it minimizes mistakes.

- Supports your strategy: It aligns with your trading style and risk tolerance.

What is a Lot Size Calculator?

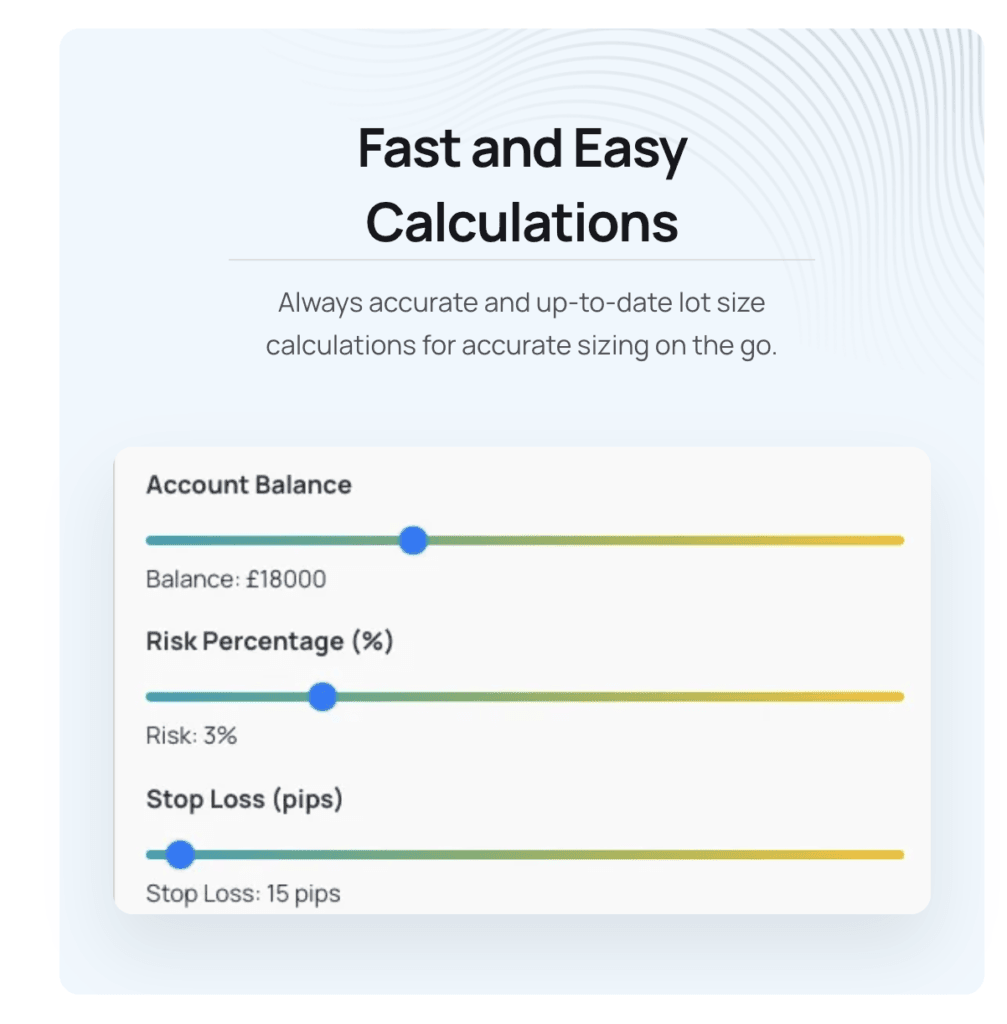

At its core, a lot size calculator is a tool designed to help you figure out how big (or small) your trade should be. It takes into account your account size, risk tolerance, stop-loss distance, and the instrument you’re trading. In other words, it removes the guesswork and ensures you’re not accidentally risking half your account on one trade.

For example, let’s say you’re trading GBP/USD. You have £10,000 in your account and want to risk 1% per trade. With a 50-pip stop-loss, a good lot size calculator will tell you exactly how many lots to trade to stick to that 1% risk level. Simple, right? But there’s more to it than meets the eye.

What Makes a Good Lot Size Calculator?

Here’s where things get interesting. Not all lot size calculators are created equal. A good one should feel like a trusty sidekick—reliable, versatile, and always ready to help. Here are the key features to look for:

1. Currency Pair Selection

Different currency pairs have different pip values, so your calculator needs to adapt. For instance, a pip in GBP/JPY isn’t worth the same as a pip in EUR/USD. A good calculator will account for these differences automatically.

2. Account Currency and Balance

Traders don’t all work in USD. Whether your account is in GBP, EUR, or another currency, the calculator should handle conversions seamlessly. It should also let you input your exact account balance, whether it’s £1,000 or £100,000.

3. Risk Parameters

Risk management is everything in trading. A quality calculator will let you set:

- A percentage of your account to risk (e.g., 1% or 2%).

- A fixed monetary amount to risk (e.g., £50).

4. Stop-Loss Distance

Your stop-loss distance (in pips) is crucial for determining lot size. A good calculator lets you input this easily, whether you’re working with tight 10-pip stops or wider 100-pip buffers.

5. Volatility Adjustments

Advanced calculators, like the one on lotsizecalculator.co.uk, take it a step further by incorporating volatility metrics. For instance:

- Highlighting whether a trade’s risk is high, medium, or low based on historical volatility.

- Allowing you to use indicators like Average True Range (ATR) to set smarter stop-loss levels.

6. Support for Multiple Instruments

If you trade more than just forex, your calculator should accommodate that. For example:

- Gold (XAU/USD) requires unique pip value calculations due to its higher price volatility.

- Cryptocurrencies like Bitcoin (BTC/USD) have their own quirks, including larger spreads and margin requirements.

7. User-Friendly Interface

Let’s be honest: no one wants to fiddle with a clunky tool when the markets are moving. A great lot size calculator should have a clean, intuitive design. You should be able to input your details and get your answer in seconds.

8. Extra Features

Some calculators go above and beyond with features like:

- Real-time pip value and margin calculations.

- Risk-reward ratio analysis.

- Pair-specific insights, such as typical volatility or key economic influences.

The Calculator Swiss Army Knife

Here’s where things get exciting. While most calculators stick to the basics, some, like the one on lotsizecalculator.co.uk, act more like a Swiss Army knife for traders. Let’s break down what makes it stand out:

- Integrated Volatility Metrics: Automatically adjusts your trade’s risk level based on market conditions. This means you’re not flying blind during volatile periods.

- Dynamic Risk Summaries: Provides an easy-to-read summary of whether your trade is high, medium, or low risk.

- Support for Multiple Assets: Whether you’re trading forex, commodities, or crypto, it’s got you covered.

- Custom Parameters: Lets you tweak settings to fit your unique trading style, from scalping to swing trading.

- Educational Tips: Offers built-in guidance to help you understand the “why” behind the calculations.

It’s not just a calculator—it’s a complete risk management companion.

Why Lot Size Calculators Are Essential

Even with all the advanced tools available today, lot size calculators remain a staple for good reason:

- They Keep You Disciplined: A calculator ensures you stick to your risk management rules, even when emotions run high.

- They Save Time: No need to manually crunch numbers when the markets are moving.

- They Reduce Errors: Human mistakes can be costly; a calculator eliminates guesswork.

- They Adapt to Your Needs: Whether you’re trading small positions or managing a larger portfolio, a good calculator scales with you.

Final Thoughts

Choosing the right lot size calculator is about finding a tool that fits seamlessly into your trading routine. Our advice is to look for one that supports your preferred instruments, adapts to your risk parameters, and simplifies your workflow. A great calculator isn’t just a utility—it’s a tool that empowers you to trade smarter, safer, and more confidently.

While there are many options out there, some calculators, like the one on lotsizecalculator.co.uk, go the extra mile with advanced features and a user-friendly design. But no matter which calculator you choose, the key is to use it consistently as part of your risk management strategy.

Remember, trading isn’t about taking wild risks. It’s about calculated decisions. So next time you’re preparing for a trade, take a moment to calculate your lot size. Your account balance—and your future self—will thank you.