If you’ve ever dipped your toes into the world of trading, you’ve likely felt the sheer intensity of it all. Price charts light up like fireworks, headlines scream market-moving news, and suddenly, you’re knee-deep in terms like “pips,” “lots,” and “margin.” It’s enough to make anyone feel overwhelmed.

But here’s the thing—there’s no need to go it alone. Amidst the chaos, some tools can bring clarity and help you make smarter trading decisions. One of the unsung heroes of this toolkit? The humble lot size calculator.

I can’t overstate how important it is to get your lot size right. Whether you’re a fresh-faced beginner or a seasoned trader, it can make or break your trading strategy. Let’s dive into why lot size calculators are so critical, how they work, and how you can use them to supercharge your trading.

Why Lot Size Calculators Matter

Let me paint you a picture: You’ve spotted a great trade setup on EUR/USD. You’re excited, confident even. You enter the trade, but within minutes, the market goes against you, and suddenly, half your account is wiped out. What went wrong? Nine times out of ten, the culprit is poor risk management, and often, it starts with not knowing how to size your position.

A lot size calculator solves this problem by doing the math for you. Instead of guessing how many lots to trade, it calculates the exact position size that aligns with your risk tolerance and account size. It’s like having a risk-management expert sitting on your shoulder, whispering, “Not too big, not too small—just right.”

How Lot Size Calculators Work

Using a lot size calculator is surprisingly straightforward. Here’s how most of them work:

- Input Your Account Currency

Start by selecting your account currency (e.g., USD, GBP, EUR). This ensures the calculator uses the correct conversion rates for any trades involving different currencies. - Choose Your Currency Pair

Pick the pair you’re trading, such as GBP/USD or EUR/JPY. Each currency pair has different pip values, so the calculator needs to know which one you’re working with. - Set Your Stop-Loss in Pips

Enter the distance of your stop-loss in pips. For example, if your stop-loss is 30 pips away from your entry price, input “30.” - Decide Your Risk Amount

Specify how much you’re willing to risk on the trade—either as a percentage of your account or a fixed dollar amount (e.g., $50). - Get Your Lot Size

Hit “Calculate,” and the tool will tell you the ideal lot size to trade. For example, it might say, “0.15 lots.”

This process takes mere seconds but can save you from massive headaches—and massive losses.

My Personal Experience with Lot Size Calculators

I’ll be honest: When I started trading, I didn’t take position sizing seriously. I was all about chasing profits, often risking way too much on a single trade. One particularly bad day, I over-leveraged on a USD/JPY trade, and a sudden spike wiped out 30% of my account in minutes. That was my wake-up call.

Since then, the lot size calculator has been my trusty sidekick. It’s saved me countless times from over-leveraging and helped me stay disciplined, even when tempted to “go big” on a promising setup. It’s a simple tool, but its impact on my trading journey has been profound.

Real-Life Example: Calculating Lot Size for EUR/USD

Let’s walk through an example to show how a lot size calculator works in practice.

Imagine you have a $5,000 trading account and want to risk no more than 1% per trade—that’s $50. You’re trading EUR/USD, and your stop-loss is 20 pips.

Here’s what happens:

- Input your account currency: USD.

- Select the currency pair: EUR/USD.

- Enter the stop-loss: 20 pips.

- Set your risk: $50.

- The calculator tells you to trade 0.25 lots.

Now, you’ve got a precise lot size that ensures you’re only risking $50 if the trade goes against you. No guesswork, no stress—just a calculated, controlled approach.

Common Mistakes to Avoid with Lot Size Calculators

- Ignoring Stop-Loss Placement

A lot size calculator is only as good as the stop-loss distance you provide. If your stop is too tight, you risk being stopped out unnecessarily. If it’s too wide, you risk losing more than you intended. - Overestimating Risk Tolerance

Be honest about how much you can afford to lose. Stretching beyond your risk tolerance often leads to emotional trading. - Forgetting to Adjust for Volatility

Some currency pairs (like GBP/JPY) are more volatile than others (like EUR/USD). Adjust your lot size accordingly for high-volatility trades.

Advanced Uses for Lot Size Calculators

- Scaling Into Positions

Use the calculator to determine lot sizes for scaling into a trade. For example, you might start with a smaller lot size and add positions as the trade moves in your favor. - Multi-Asset Portfolios

If you trade multiple instruments (e.g., forex, indices, commodities), a lot size calculator can help you balance risk across all your trades. - Backtesting Strategies

Use the calculator to simulate historical trades and analyze how proper position sizing would have impacted your performance.

Where to Find Lot Size Calculators

The good news is that lot size calculators are widely available, often for free. Here are a few places you can find them:

- Broker Websites

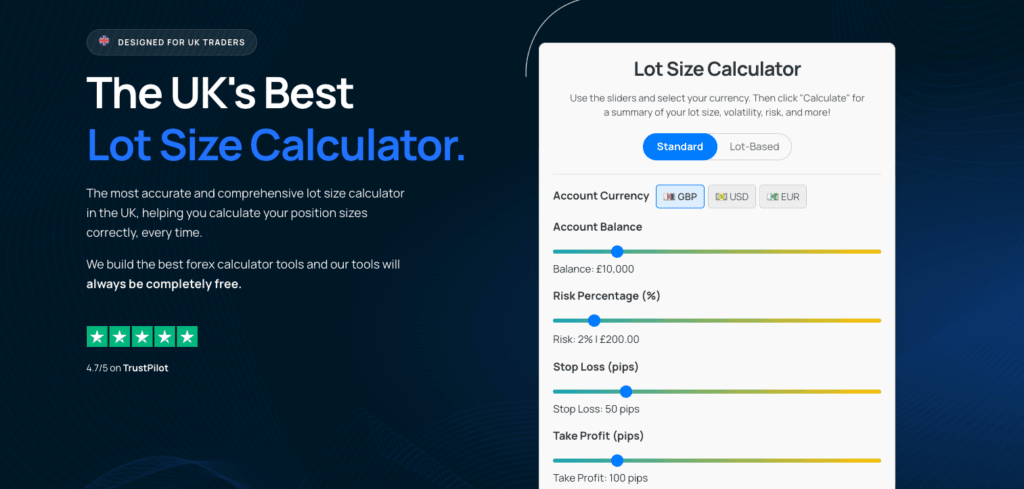

Many brokers, like Pepperstone or Vantage Markets, offer free lot size calculators as part of their trading tools. - Standalone Tools

Websites like Myfxbook, BabyPips and Lot Size Calculator provide intuitive calculators that are easy to use. - Mobile Apps

If you trade on the go, apps like MetaTrader or TradingView often have built-in position size calculators.

Pro Tip: Double-check your lot size in your trading platform before placing the trade. While calculators are reliable, it’s always good to verify.

Benefits of Using Lot Size Calculators

Still on the fence? Here are a few reasons why every trader should use a lot size calculator:

- Protects Your Account

By sticking to a consistent risk level, you avoid catastrophic losses that could blow up your account. - Eliminates Guesswork

Trading is stressful enough. A calculator removes the mental burden of doing the math under pressure. - Builds Discipline

Using a calculator forces you to stick to your risk management rules, even when tempted to over-leverage. - Adapts to Market Conditions

Whether you’re trading volatile pairs like GBP/JPY or slower movers like EUR/CHF, a lot size calculator adjusts accordingly.

Pro Tips for Beginners

- Stick to a Risk Percentage

Start with 1% or 2% of your account per trade. It might not sound exciting, but it keeps you in the game for the long haul. - Combine with Other Tools

Pair your lot size calculator with a risk/reward calculator to ensure your trades have a favorable potential payout. - Practice with a Demo Account

Before using real money, practice calculating lot sizes on a demo account. It’s a risk-free way to build confidence.

Final Thoughts

In the world of trading, managing risk isn’t just a best practice—it’s critical to your long-term success. And the lot size calculator is one of the simplest, most effective tools for staying in control.

Think of it as your risk-management compass -whether you’re a beginner navigating your first trades or an experienced trader refining your strategy, this tool is a must-have in your arsenal.

So, the next time you spot a great trade setup, take a moment to calculate your lot size. Your future self—and your trading account—will thank you.

Here’s to calculated trades, disciplined risk management, and a successful trading journey. Now, go out there and trade smart!