Are Lot Size Calculators Dead in the Age of AI?

AI is taking our jobs! That’s the cry echoing across industries, from copywriting to coding, and yes, even trading. But here at Lot Size Calculator, we’re not ones to panic (well, not too much). Instead, we’re taking a cheeky look at how artificial intelligence is reshaping the trading world and, in particular, the tools traders have relied on for years. Are lot size calculators still relevant in this brave new AI-driven age? Or has their time come and gone? Spoiler: They’re not going anywhere just yet.

The Rise of AI in Trading

Artificial intelligence has made waves in trading, revolutionizing how we analyze markets, execute trades, and even manage portfolios. From algorithmic trading systems that react faster than any human could, to AI assistants like ChatGPT that can answer complex trading questions or even write custom indicators—it seems like there’s nothing AI can’t do.

AI tools offer:

- Real-Time Insights: They crunch massive amounts of data at breakneck speed, identifying patterns and trends in ways that were once impossible.

- Predictive Analysis: Using historical data, AI can forecast potential price movements with a level of precision that leaves human analysts in the dust.

- Automated Execution: Algorithms can open and close trades without any human intervention, saving time and, potentially, money.

- Portfolio Optimization: AI models can assess your portfolio’s risk and suggest improvements based on market conditions.

It’s impressive stuff, but here’s the thing: even the flashiest AI tools have their limitations. They might predict market trends or identify lucrative setups, but they’re not always great at the nitty-gritty, like ensuring you’re risking the right amount on each trade. And that’s where lot size calculators come into play.

Why Lot Size Calculators Still Matter

If AI is the Ferrari of trading tools, then the lot size calculator is the reliable workhorse. It doesn’t try to do everything; instead, it focuses on one crucial task: calculating your position size quickly and accurately. And while AI might handle the big picture, a lot size calculator ensures the details don’t trip you up.

Simplicity at Its Best

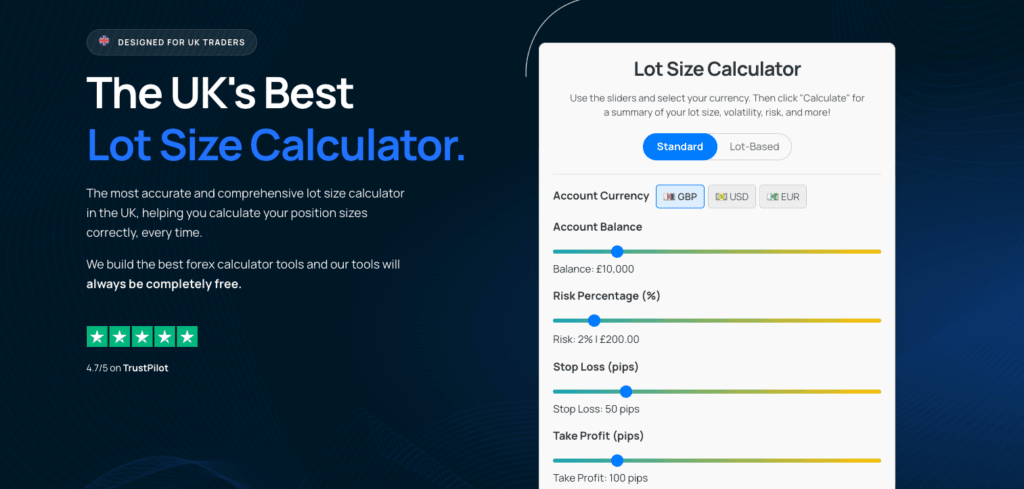

A lot size calculator is simple, reliable, and doesn’t require a degree in computer science to use. Input your account size, risk percentage, stop-loss distance in pips, and currency pair, and in seconds, you have the precise lot size needed to manage your risk effectively. There’s no steep learning curve or complex setup—just plug and play.

Focus on Risk Management

At its core, trading is about managing risk. You can have the best strategy in the world, but if you’re over-leveraged, it’s game over. A lot size calculator helps you stay disciplined, ensuring every trade aligns with your risk tolerance and account size.

Independence from AI’s Shortcomings

AI tools are powerful, but they’re not foolproof. They can struggle with:

- Data Gaps: AI models rely on historical data, which can be misleading during unprecedented market events.

- Overfitting: Some algorithms are too specific to past conditions and fail to adapt to new trends.

- Complexity Overload: Sometimes, you just need a straightforward solution—and that’s where a lot size calculator shines.

AI vs. Lot Size Calculators: The Showdown

Let’s pit these two tools against each other and see where each excels.

The Case for AI

AI is great for:

- Market Analysis: Spotting patterns and trends across multiple asset classes.

- Strategy Testing: Running simulations to see how strategies perform under various conditions.

- Time-Saving: Automating repetitive tasks, like scanning charts or executing trades.

The Case for Lot Size Calculators

Lot size calculators excel at:

- Precision: Calculating the exact position size needed to manage risk effectively.

- Simplicity: Providing answers without the need for extensive technical knowledge.

- Consistency: Ensuring you stick to your risk management plan, trade after trade.

How They Can Work Together

Rather than viewing AI and lot size calculators as competitors, think of them as teammates. Here’s how:

- AI Analyzes; Calculators Execute: AI identifies trading opportunities and provides insights, while the calculator ensures your position size aligns with your risk tolerance.

- Custom Calculator Features: Some traders are now integrating AI into their lot size calculators, creating hybrid tools that adjust for volatility, dynamic stop-loss levels, and even news events.

- Learning Through AI: Tools like ChatGPT can teach traders how to use lot size calculators effectively, demystifying the math and concepts behind them.

Lot Size Calculators for Different Markets

Forex

The forex market’s high leverage and varying pip values make lot size calculators indispensable. Whether you’re trading EUR/USD with a 10-pip stop or GBP/JPY with a 50-pip stop, the calculator ensures your position size is spot on.

Gold

Gold (XAU/USD) is a different beast. Its high volatility means you need to adjust your position sizes carefully. A lot size calculator designed for gold takes into account its unique characteristics, such as larger tick values and rapid price movements.

Bitcoin

If gold is volatile, Bitcoin is downright chaotic. A single news headline can send BTC/USD soaring or plummeting. A calculator helps you manage this unpredictability, ensuring your position sizes are conservative enough to handle massive swings.

Commodities

From oil to natural gas, commodities often have larger tick sizes and can be influenced by geopolitical events. A calculator tailored for these markets helps you adjust for these factors, keeping your risk in check.

What’s Next for Lot Size Calculators?

As AI continues to evolve, we might see even more integration between traditional tools and cutting-edge technology. Imagine a lot size calculator that:

- Adjusts position sizes based on real-time volatility.

- Warns you of upcoming economic events that could impact your trades.

- Syncs with your trading platform to automate position sizing and execution.

These hybrid tools could offer the best of both worlds, combining the simplicity of a calculator with the analytical power of AI.

Final Thoughts

So, are lot size calculators still relevant in the age of AI? Absolutely. While AI has transformed trading in remarkable ways, it hasn’t rendered the trusty calculator obsolete. In fact, the two complement each other beautifully.

AI handles the big-picture analysis and automation, but when it comes to the nuts and bolts of managing risk, the lot size calculator is still king. It’s quick, reliable, and, best of all, simple—qualities that even the most advanced AI tools can’t always replicate.

So next time someone tells you AI is taking over, remind them: some tools stand the test of time. The lot size calculator might just be one of them….